This post may contain affiliate links where I earn a commission, at no additional cost to you, if you decide to make a purchase after clicking on a link. Please see our Disclosure Policy for full details. Thank you for your support!

A biweekly pay schedule is actually very common, but it can make budgeting a little trickier at first. If you’re a gig worker, commission-based, self or seasonally employed, you may not have the luxury of being able to budget your money monthly. That’s okay, because biweekly budgeting exists and I’m going to show you the ins and outs of creating your own biweekly budget!

A biweekly budget is an imperative skill to have if your income is inconsistent, or if you are paid biweekly, because it’s the true way to tell your money what to do each pay period and reach your financial goals.

Download the FREE Easy Budget Biweekly Budget Template HERE

Here is How to Budget Biweekly:

1. Budget by biweekly paycheck

Instead of doing one traditional monthly budget, create a separate budget for each check that you get every 2 weeks. This way you can tell the money from each individual paycheck exactly where want it to go before it even arrives! When you budget biweekly like this, you will essentially be working in 2-week increments. Most months will have 2 biweekly checks and the month will last for 4 weeks. But twice a year you will have months with 3 paychecks that last for 6 weeks.

You will (very) loosely follow a monthly calendar, but your budget will not always fall perfectly within any month, because you’re actually following your pay dates instead of the calendar dates.

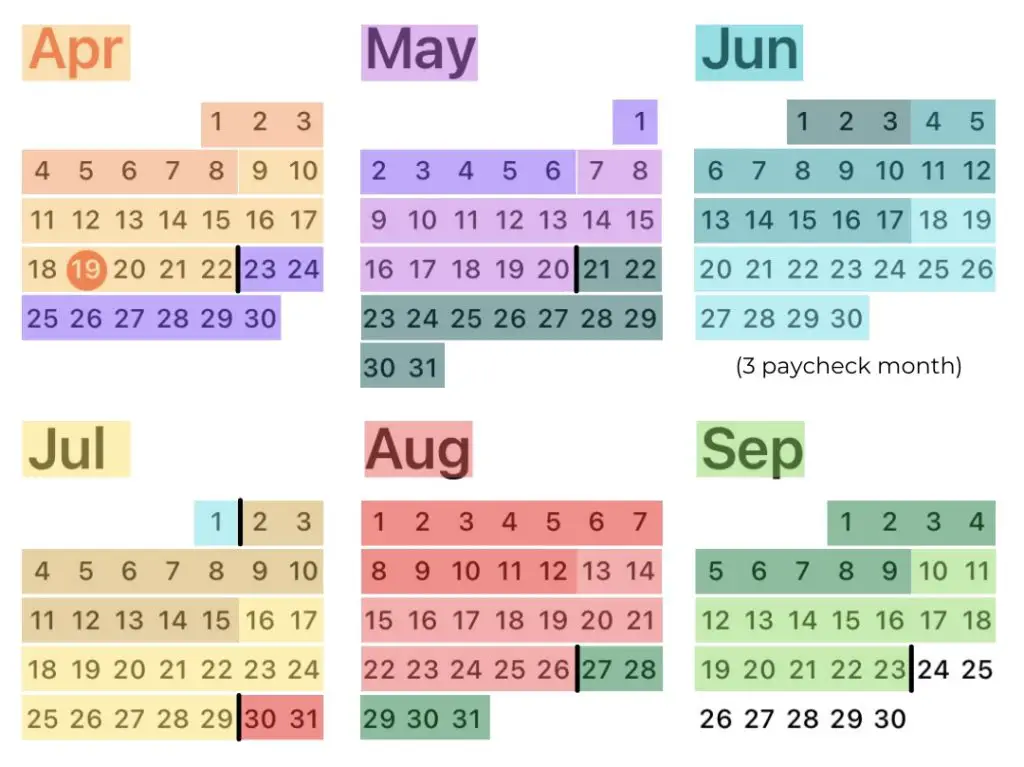

This can seem very confusing at first. Spend a few minutes looking at the sample calendar below to get an idea of what I’m talking about.

In the sample calendar above we have a:

- Biweekly budget at a glance

- Each month is color coded but broken down into sparely biweekly budgets as well (shown by light and dark shading)

- April, May, July, August, and September cover 4 weeks (loosely follow monthly calendar but not exactly)

- June is a 3 paycheck month so it covers 6 weeks

- Each month has 2-3 biweekly checks in it to budget out

- Person gets paid every Friday

- New budget starts every other Friday, and ends every other Thursday

The trickiest part about budgeting biweekly is wrapping your head around the dates constantly changing. Unlike a simple budget that starts on the 1st and ends on the 30th every month, when you get paid biweekly, that just doesn’t work! You have to start budgeting by paycheck biweekly and following the dates of your payday.

The second trickiest part about budgeting biweekly is that even though your paydays are constantly changing, your bills are usually fixed. This means that you need to plot out which bills you will pay with each paycheck ahead of time to make sure you have enough money to pay them all and keep them organized, and they won’t fall on the same check every month.

This system works particularly well for people who are paid biweekly.

It also works for those paid on commission or in the gig economy. If you’re not sure what you’re going to be paid every 2 weeks, use what you have and start from there.

Alternatively, if you are on a fluctuating or inconsistent income, budget based off of your average income amount. How do you find out what your average income amount is? Take your income for the last 6 months and divide it by 6. This is what you can expect in your monthly income. Budgeting based off of your average income amount gives you a starting point so that you’re not just pulling numbers out of thin air. Even if it’s not an exact number, it’s better than using no data to begin your biweekly budget.

I suggest setting aside 30-60 minutes the night before a new “month” starts to write out both of your biweekly budgets. This will ensure that you are prepared for the month ahead, that you go over what bills are coming out and that you are prepared to save for upcoming expenses like holidays, birthdays, or car maintenance. You can also go over last month’s budgeting wins and things that you may need to work on in the future.

2. List all of your expenses on a calendar

Next, you need to write out all your bills and expenses to see how they will line up with your biweekly budget! Print out a monthly calendar similar to the one above and write down what your bills/expenses are, how much they are and when their due dates are. You can also list these bills with their due dates beside them, or use an electronic calendar/planner.

Listing your expenses will give you an idea of how much to budget in your biweekly budgets, which bills will be paid with each check, and what dates you need to have your money ready by.

You may want to move the dates of when you pay certain bills or call your billers and ask them to change the date of your billing to make it work better for you. If this is your first time putting together a biweekly budget, listing your bills will also give you an idea of what due dates you need to shift based off of your biweekly income.

Moving around bill due dates tends to be a simple task and most, if not all, companies will want to work with you. Of course, some bill due dates may not be movable. In that case, work your budget to save half and pay the rest as it makes sense.

Are you brand new to budgeting? Learn the basics of making a budget today.

3. Split your larger expenses/bills in half

Since we are budgeting biweekly, the best method to manage your big bills throughout the month is to split them in half! This helps ease the burden of big bills like car payments, mortgage, etc. To do this, save half of the bill with your first check of the month, and then save the other half with your next check, and then pay the bill when it comes due.

That’s why listing out your bills on a calendar is so important: You need to see what bill due dates need to be shifted, if any, and if you have any big bills that you need to split up.

Here’s an example. If your mortgage payment is due on the 1st of the month and it’s $950, that may wipe out all of your paycheck and have you pinching pennies for the rest of the pay period. We don’t want that. If you split that mortgage payment in half and save $475 during the first 2 weeks of the previous month, and then save another $475 with your second check of that previous month, you’ll have the money all ready and set aside when it comes due on the 1st of the following month.

There are many ways to do this and many variations, so find what works for you!

4. Pay yourself first

Regardless of whether you’re budgeting monthly or biweekly or by year, you still need to pay yourself first. Continue to save money in your emergency fund, pay off debt or invest your money before you set aside any fun money or personal spending money.

Check out my free Sinking Funds and Savings Tracker

Paying yourself first pushes you to make your financial goals a priority instead of simply an afterthought. This is especially important if you have to budget with an irregular income. Since you cannot rely on a salary or consistent income, you need to save money for your winning seasons and your down ones.

Don’t save what is left after spending. Spend what is left after saving.

5. Track your spending

Don’t just set your biweekly budgets and forget about them. That’s the quickest way to have your money rule you instead of you ruling your money!

Track your spending throughout the month and check in with your budget often. Like paying yourself first, putting this expectation on yourself makes sure that you are making your financial goals a reality instead of just writing them down one day and ignoring them the other thirty days of the month.

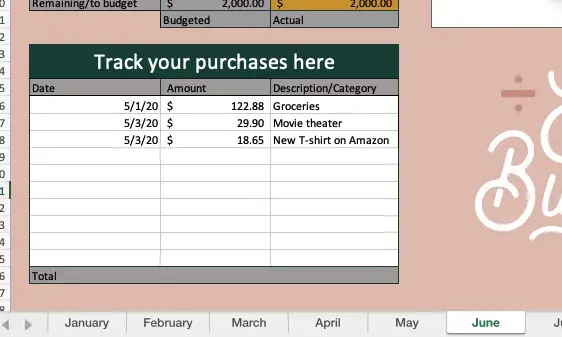

Track your spending by writing each purchase down on a piece of paper, using a spending tracker app, or logging each purchase on spreadsheet. Log the date, amount spent, item, and which budget category it falls under. This way when you go to reconcile your budget for the pay period, it’s fast and easy to add up how much you’ve spent in each category.

I use the Every Dollar app to track my spending, but it is a paid app and it isn’t laid out biweekly. However, there are many different ways to track your spending that work well. Find what works for you.

If you’re over budget on one line item, rework your budget to cover overspending. Remember: Budgets are meant to work for you and with your life— they aren’t meant to be prison guards.

Here are 10 Ways to Reset Your Budget After Overspending

6. Set up a budgeting routine

The best way to stay consistent with budgeting is to have a set routine that you never deviate from. I recommend you reconcile your budget every 2 weeks the night before payday if you are on a biweekly budget.

Reconciling, or balancing, your budget means you fill out your budget template or spreadsheet with all your spending and make sure the “amount remaining” matches what your bank actually says you have remaining.

When they do match, all your spending has been properly logged and you can quickly and easily see how much extra money you have leftover to put toward savings or debt payoff.

The Pros and Cons of Biweekly Budgets

Pros of a Biweekly Budget

1. You don’t have an excuse to not budget on an irregular income or a biweekly income

I hear objections to budgeting all the time, and one of the most common ones is that budgeting is too hard or that budgeting won’t work on a certain income type. That could not be further from the truth. Budgeting is as hard or as complicated as you make it and by budgeting biweekly we have debunked the myth that you can’t budget on an inconsistent, irregular or low income.

2. It matches up with your pay schedule perfectly if you get paid biweekly so you have more control over your finances and where your money goes

Since you are making two budget and checking in on where your money is going more regularly with biweekly budgets, you have more oversight and control over what your money is doing and where it is going. This can only help you gain more insight into your financial goals and dreams and aid you in getting to those finish lines faster.

3. It IS possible to save, pay off debt and invest your money

So many people live paycheck to paycheck in these employment situations because they simply don’t know how to budget biweekly. Now that you know you can budget biweekly, and more importantly, you know how to, you can start making traction in debt payoff, saving and investing!

Cons of a Biweekly Budget

1. It can take some work to get your budget and bills just right

One of the disadvantages of budgeting biweekly is that it does take more work to get the layout and timing of your budget and bills figured out. It does take more diligence and work at first when you are budgeting biweekly, but once you have it down, you will be so happy with how intuitive it really is!

2. There is a time sink in creating two budgets and calling your service providers to move around due dates if necessary

Like with all budgeting, there is a time cost associated with setting a budget up and tracking your spending. While I do put this in the con area, I think it’s important to note that you spend up to 40 hours making money– so spending one or two hours a month is a worthy investment to make sure you’re putting your money where you want it to go.

3. There may be some months were you overestimate or underestimate your income

Irregular, inconsistent or biweekly paychecks may have you overestimating or underestimating your income. That’s ok, because as we have said previously, while you are budgeting biweekly, you are paying yourself first. This is why that should be a priority. Since you cannot accurately forecast your exact income, you need to save for those times where your budget is a little “off”.

What About Extra Income… or Those Awesome 3 Paycheck Months?

There will be months where you have an extra paycheck. There may be months where you receive a tax refund, Christmas bonus or some other form of “unexpected” money. So, what do you do with it when you budget biweekly?

Well, there are a couple of options. My favorites include paying all of your bills one month ahead, saving the money, paying off debt or investing! There really is no wrong answer, but the most responsible thing to do if you’re budgeting biweekly is to put protections in place so you don’t have to worry as much about your finances.

Budgeting biweekly is a wonderful skill to have, because the reality in this day and age is that the future is uncertain and you may find yourself in a position where budgeting biweekly is the best plan of action for yourself and your family.

While biweekly budgeting can be complex at first, my hope is that this article makes the process more streamlined and manageable for you!

Don’t forget to download my FREE digital budget template which makes it easy to set up a biweekly budget! You can also quickly set up a monthly, or even a weekly budget with this template. It’s not magic, it’s my incredible design where adding a new paycheck budget is as easy as one click!

Want more detailed help? Join my beginner course Budget to Debt Freedom for in-depth instructions and video tutorials of setting up your budget, routine, and debt-payoff plan.