This post may contain affiliate links where I earn a commission, at no additional cost to you, if you decide to make a purchase after clicking on a link. Please see our Disclosure Policy for full details. Thank you for your support!

So you’re ready to start budgeting, but the balancing part always brings up feelings of dread and despair, right? No more! Today, I will walk you through how to balance your budget step-by-step.

You will want to balance, or reconcile, your budget no matter what budgeting method you are using. There are dozens of methods and with all of them these general steps will apply.

I personally use and am writing from the point of view of using a zero-based budget, budgeting out each paycheck, and doing it digitally with a spreadsheet.

Related reading: How to Make a Budget: Step-by-Step Guide + FREE Excel Template

Zero-based budgeting is where you budget every dollar. Income – Expenses = $0 so that no dollar is left unplanned, and the expenses include all money sent to savings and used to pay off debt too, so you’re still reaching your goals the whole time! It’s important to note that with this method, your bank account never actually hits $0.

It’s also important to budget out each paycheck! You need to be planning out the actual dollars you receive and what those dollars are actually going to be spent on. The timing matters!

Honestly, it’s my humble opinion that zero-based budgeting by paycheck is the ONLY and BEST way to budge. My track record would speak for itself! We paid off $71k of debt in 2.5 years and saved up $20k the next year using this method. So believe me, it works! I’ve had clients with similar results.

But I digress, back to balancing your budget!

What Does Balancing Your Budget Mean?

To put it simply, balancing your budget is the act of sitting down to track your spending, update your budget with the amount you’ve spent, and cross check it with your bank account to ensure all is accounted for properly.

Your budget should have a section where you plan how much you’re going to spend at the beginning of the pay period, and then a section where you write in the exact amount you actually spent in each category as the weeks go on. The plan and reality are rarely going to be exactly the same!

This process can really trip up new budgeters, and honestly, it will probably take you a little while to figure out! Your bank account, spending tracker, and budget will each have their own quirks and you’ll need to figure out the exact process that works for you, but the steps will look something like this.

HOW TO BALANCE YOUR BUDGET: STEP-BY-STEP

1. Open up all Budgets, Tools, and Accounts

- Bank accounts (checking accounts and credit cards currently in regular use)

- Budget spreadsheet

- Spending Tracker

2. Sort all new spending and income transactions with your spending tracker

Review all your spending since you last balanced your budget and sort all the transactions into the categories they go in. I highly recommend the Every Dollar Plus app to track your spending. It connects to your bank account so you never miss a transaction and don’t have any accidental duplicates either! This makes sorting all your spending into categories a breeze. By the end of this step, you should know how much you’ve spent in each category because your spending tracker app will tell you. If you are doing it on paper instead of an app (not recommended), total the categories up by hand.

Recommended spending tracker apps:

- Every Dollar Plus (this is the one I personally use and recommend)

- Mint

- PersonalCapital

3. Write the total spent in each category into your master budget

This step is easy, just grab the total you spent in gas, groceries, restaurants, household, bills, and all your other categories into your master budget! Make sure you type everything in correctly! You should now be able to see how much you’ve spent in each category up until this point, plus see the total spent, and the total amount of money remaining for this pay period/budget.

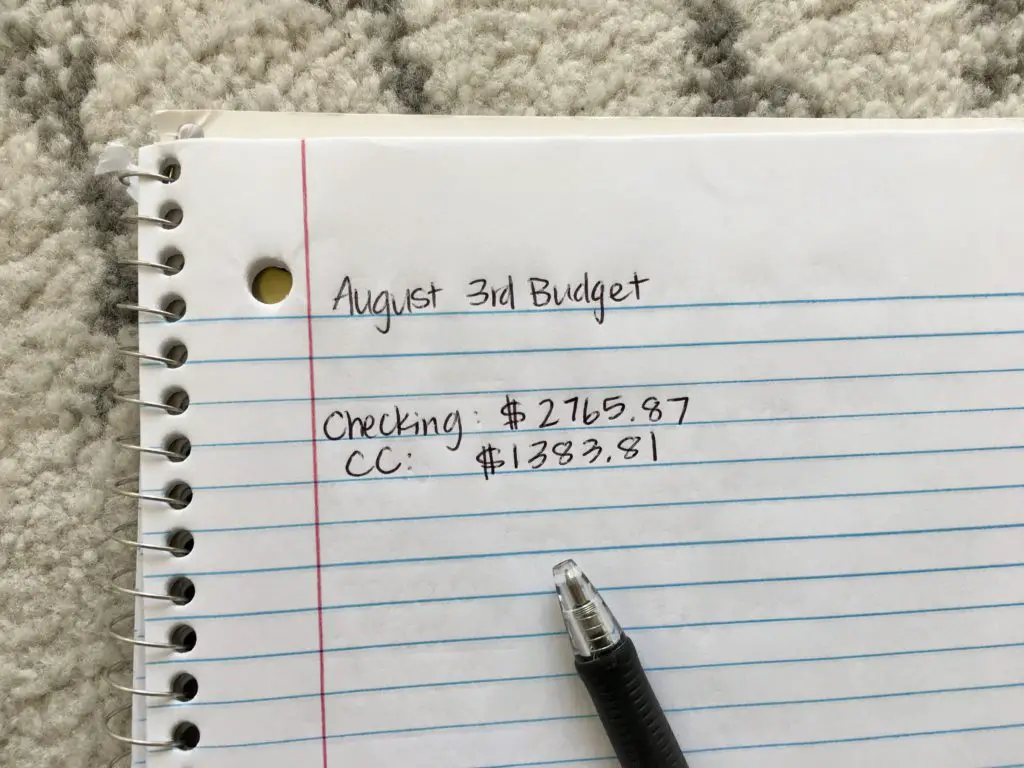

4. Look up the current balances on your checking account/s and CCs (in use)

Next, switch from looking at your budget to checking your actual bank accounts to see how much money you actually have left! Grab a piece of paper and write down how much money is remaining in your main checking account.

Note: If you use multiple bank accounts for your purchasing and spending, you will need to add up the grand total. This includes subtracting any credit card spending you did in this pay period that you plan to pay off immediately. I highly recommend only using one checking account and no credit cards to make this step easy.

However, if you have multiple checking accounts and credit cards that you’re spending money on and the transactions are all part of your budget, you’ll need to do some math to figure out the grand total of all the accounts. This may look like $625 remaining in checking 1 + $324 remaining in checking 2 – $456 we spent on the credit card = $493 remaining, assuming you are going to pay the credit card off this pay period.

5. Make sure the “total remaining” on your budget matches the “total remaining” in your bank account

If you don’t use any credit cards and you’ve typed everything into your budget correctly, the amount “remaining” in your budget will now match the “remaining” in your bank account. That’s how you know your budget is completely balanced!

You’re now done and can review your spending to see how you’ve done. You can sleep easy knowing your money is all accounted for and organized!

And now, you’re done! Great job!

If it’s the end of the pay period, move any leftover money toward your main goal like debt or savings. If you still have a few days remaining on your current budget, repeat these steps again the night before you get paid to close out your budget for the pay period.

Having trouble reconciling your budget? See my top four troubleshooting tips below.

Top 4 Things That Will Throw off Your Reconciliation

1. Money that was in your bank account before your new budget started

Don’t forget that the money remaining on your “budget” won’t match the amount of money remaining in your “checking account” if you haven’t accounted for any money that was in your account before your budget started! As soon as we get paid I always send all leftover money from the last pay period off to savings (or debt) to zero out the account for a fresh start to the new pay period. A little timing hack I use: I don’t move the money until we’ve gotten paid again so the checking account never hits $0.

2. Typing things in incorrectly

If you’ve done all the steps correctly but you’re just a few dollars or cents off, double check all the numbers to make sure you entered them correctly

3. Pending transactions on your bank accounts

Don’t forget to account for pending transactions! If something is still pending on your checking account, for example, the money may have been deducted from your checking account but the transaction won’t show on your spending tracker yet, making your budget show you have more money left than your checking account! Little quirks like this are common, account for these however you like.

4. Credit card balances

If you use a credit card, you should be paying it off every time you balance or every pay period. Basically, as often as possible! Don’t forget that your checking account may show you have lots of money leftover, but you have to remember to subtract that credit card balance since you’re going to be paying it off from that checking account balance soon, and all the transactions you spent on the credit card have been entered into your “budget.”

I hope this helps! It may sound like a lot, but once you get the hang of things, you’ll be a pro!

If you have any questions, feel free to leave me a comment below!

Did you enjoy this post about how to balance your budget step-by-step? Save it to Pinterest for later!

3 Responses

Thanks for posting this, it makes a lot of sense! I really love your system. I am curious how it works for you at the end of the month. It seems like in Everydollar at the end of the month it would have all of the expenses for both pay periods in there, do you have any tricks for separating them out so you get an accurate count for say how much groceries were the second pay period? Or maybe just simple math 🙂

Hey Jessica! You are correct about Every Dollar!! I just take the total in whichever category I’m looking at and subtract what I spent in the first pay period to figure out how much of it was spent in the second pay period. It’s really quick because it’s only for 6-7 of my variable spending categories I have to do that for. Bills aren’t like that. You could also create separate spaces for them in Every Dollar!