This post may contain affiliate links where I earn a commission, at no additional cost to you, if you decide to make a purchase after clicking on a link. Please see our Disclosure Policy for full details. Thank you for your support!

Are you ready to take control of your money by creating a monthly budget? If so, you’ve come to the right place! Budgeting sounds daunting, but once you get the hang of it, it’s absolutely life-changing. Budgeting will help you pay off debt, save more, reach your financial goals faster, and feel more organized. Today, I’m going to teach you how to make a monthly budget that you can use for the rest of your life.

I also have a free excel template you can download to plug your new budget into!

In this tutorial, I am going to show you how to do spreadsheet budgeting on Excel or Google Sheets. I like this method better than pen and paper because it’s fast, accurate, and easy to edit on-the-go.

Before I dive into teaching you how to make a budget, I recommend you download my FREE Digital Budgeting Spreadsheet. Once you have it downloaded on Excel or Google Sheets, read through these instructions and you’ll be able to build your budget on the spreadsheet as you go!

This is the exact budgeting method and spreadsheet we used to pay of $71k of debt in less than 3 years on a single income. It was a wild ride, but it was so worth it! For us, budgeting has been absolutely life-changing! We still use it to this day to help us plan our money, save more, and live within our means.

Related reading: How We Paid Off $71k of Debt in Less Than 3 Years on a Single Income

Ready? Let’s dive in!

HOW TO MAKE A BUDGET: STEP-BY-STEP GUIDE

Step 1- Understand What a Zero-based Budget is

You are going to be creating a zero-based budget.

A zero-based budget means that you make a plan for every single dollar that you earn, down to the penny, before the month starts. Zero dollars will be left unbudgeted!

Typically, you might plan out all your expenses and then have some money leftover. Don’t leave that money unbudgeted. Plan for it to go to savings or toward your debt, and then you’ll have a zero-based budget! Any outgoing money is considered an expense, even extra debt payments or savings.

To summarize:

INCOME – EXPENSES = $0

Remember, this does not mean you are spending all your money. We are simply including all outgoing money (bills, spending, savings, extra debt payments, etc.) in our expenses so that every single dollar that comes in, goes out and right where it belongs instead of sitting in your bank account tempting you to spend it!

Step 2- Gather Your Budgeting Materials

Now, let’s gather the materials we will need in order to budget propoerly.

Materials You Will Need to Make Your Budget:

1. Excel or Google Sheets Budget Template (Download my FREE Digital Budgeting Spreadsheet)

2. Spending Tracker

You should use a spending tracker to keep track of each of your transactions during the month. It’s very important to track every transaction!

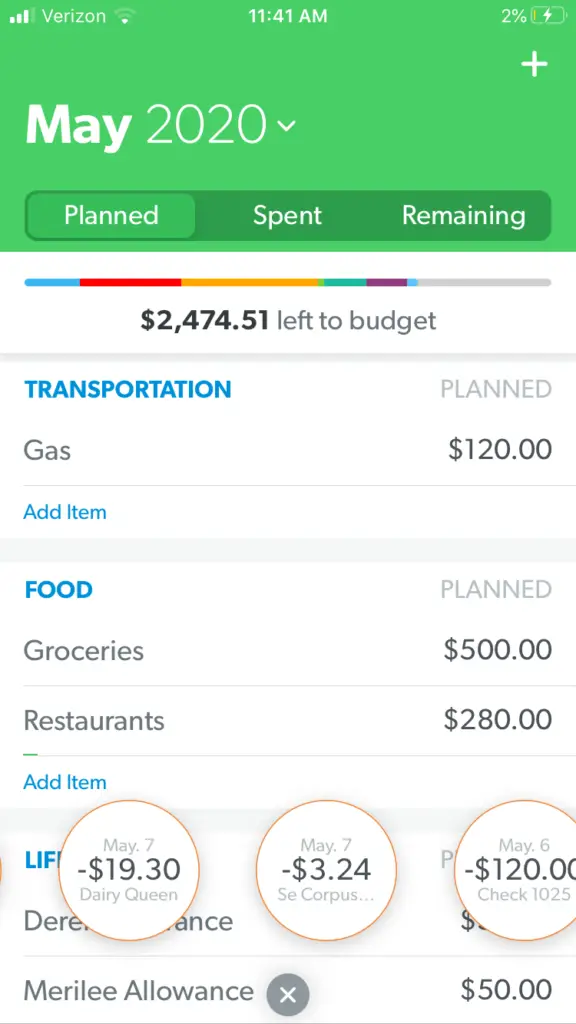

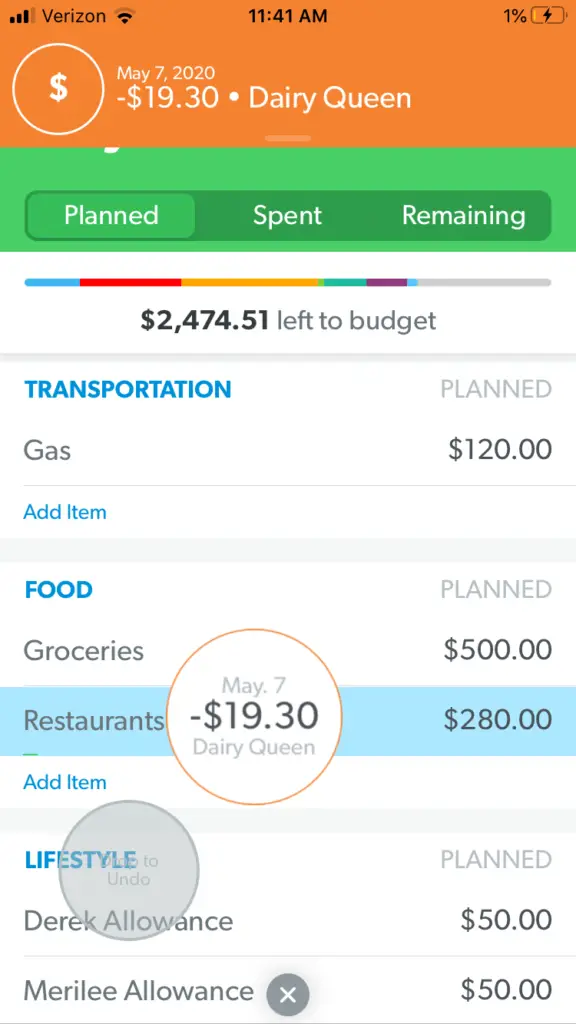

I personally use the paid app Every Dollar (on my 3rd year). The app costs me $10 a month but it’s worth every penny! It’s very intuitive. It connects to my bank accounts and every time I spend or earn money, a bubble pops up in my app which I can then sort into its proper budget category. This is how I keep track of each of my transactions each month. There is a free version too that many people love! It has the same interface, it just doesn’t connect to your bank accounts and pull in transactions automatically.

You can also track your spending on the free Mint app, on a piece of paper, or do it directly on your budget spreadsheet in the bottom lines I’ve provided on the FREE Digital Budgeting Spreadsheet).

All of them work. Find the one that works best for you!

3. Bank records from last 3 months (printed out, recommended)

Make sure you print out every single record from the last 3 months, including all credit card statements, checking account statements, etc. Print everything that has any record of your money that came in our went out.

4. Calculator (I use my phone)

5. Pen and paper (I use a cheap $.98 notebook)

Step 3- Setting up Your Budget

Next, I am going to show you how to set up your budget. Feel free to skip to my video tutorial if you are a visual person. Once you’ve watched it, come back here and finish reading so you don’t miss any important details!

Budget Out Each Paycheck Individually

This is the best way to budget because you will be determining what the dollars from each paycheck are actually and literally going to be paying for. It is so much easier to keep track of your dollars when you think of it this way! You are basically going to budget by paycheck, or do paycheck budgeting.

Follow these steps for each paycheck.

On your digital budgeting spreadsheet, for each paycheck, fill out the following:

1. Write in Your Income. Using your Budget Spreadsheet, write down your expected income under the “income” section. List each paycheck out separately in the sections provided.

2. Create Categories. Moving down to the expenses section, write down all the categories you typically spend money in. Be specific here. Vague categories make your spending harder to track. Include categories for all bills, spending, debt payments, and savings. See below for common budget categories.

3. Estimate Your Expenses. Now that you have categories, list out the amount you expect to spend in each category in the “budgeted” column. Keep reading for how to determine how much to plan in each category.

Related reading: How to Budget Your Irregular Income

Common Budget Categories:

FIXED:

Rent/Mortgage

Auto Insurance

Health Insurance

Life Insurance

Other Insurance

Subscriptions

Mobile Phone Bill

Utilities

Electricity

Internet

VARIABLE:

Groceries

Restaurants

Gas

Personal Allowance

Date Night

Clothing

Entertainment

Household

Haircuts/Grooming

Gifts

MISCELLANEOUS:

Write in a category for any expense unique to the month you are currently budgeting for that doesn’t tend to repeat.

Example:

Mom’s Birthday Gift

Johnny’s School Supplies

Tree Trimming

New Office Chair

Step 4- Determine How Much to Budget in Each Category

Hopefully you printed out your last 3 months worth of bank statements. Go through every single transaction and label it with the budget category it falls into. Then, add up the total of each category and divide it by three to get the average spent in each category over the last three months.

Example:

$2475 spent on groceries the last 3 months

$2475 ÷ 3 months = $825/month spent on groceries

Next, determine where you need to cut back. If you are struggling to make ends meet or spending more than you make every month, look at the categories you feel are the least essential and where your spending is the least controlled.

Typically, you’ll be able to make big cuts in your restaurant, personal spending, groceries, entertainment, and miscellaneous categories. Try cutting back at least 10% in each one and setting that as your new budget. Don’t be afraid to cut back more if you know you’re spending way too much.

Example:

We would cut the $825/mo we have been spending on groceries back by 10% for a new grocery budget of $740/mo.

Now you have a budget set up with all the categories you’ll need, and you’ve made a plan to cut back a bit going forward! Great job.

Sample Budget

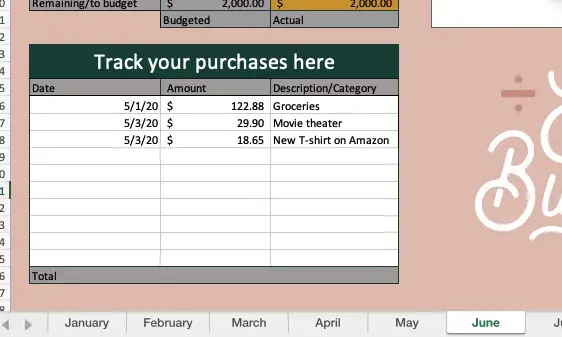

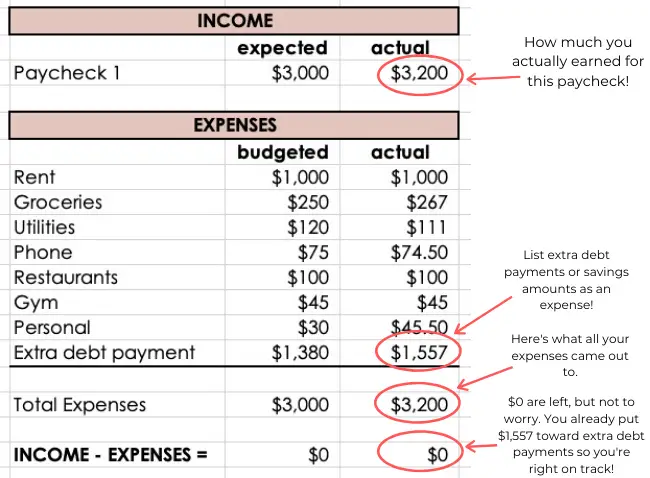

Let’s take a look at a sample budget and put all of this information into practice. Scan through these numbers and then we’ll break them down!

Next, let’s break this down to make sure we really understand what we’re looking at.

Step 5- Balance Your Budget Each Week to Stay on Track

It’s important to balance your budget regularly to make sure your budget is on track.

What is Balancing the Budget?

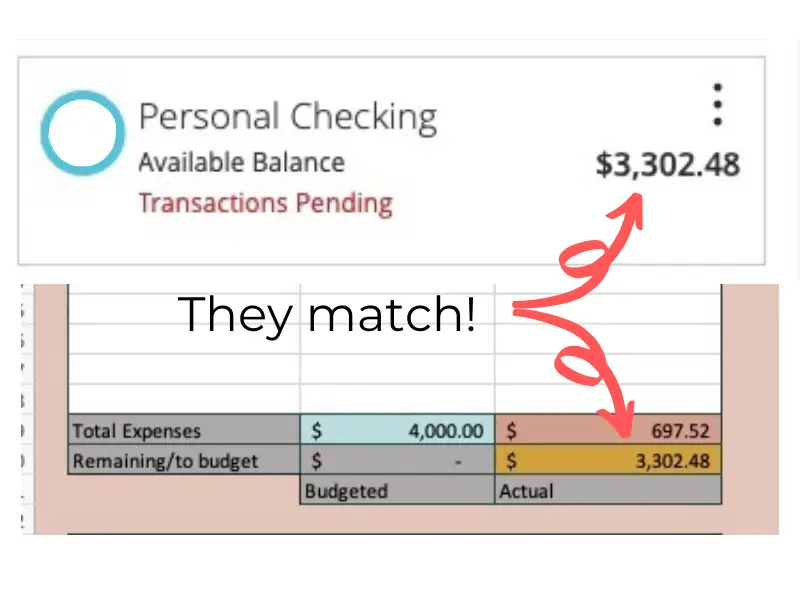

Balancing the budget means making sure the money you actually have remaining (your bank balance) matches what you think you have (what your budget says you should have). In order to do this, you need to update your budget with all of your transactions. Then, they should match.

Note: If you have any pending transactions, they may not match 100%. You will have to do some math to figure out what your bank balance would be after all the pending transactions go through.

How to Balance Your Budget:

Once you get paid and begin to spend money during the month, use your spending tracker to keep track of each transaction, both incoming and outgoing.

To balance your budget, pull up all your materials and start filling out your Budget Spreadsheet’s “spent” column with how much you’ve spent up until that point. Your spending tracker will itemize each purchase you’ve made in each category. Your Budget Spreadsheet will only show the totals.

Now you can see how much of your money you’ve spent!

How Often to Balance Your Budget

You should balance your budget very regularly. I do it weekly, and I recommend you do it weekly too. If you go much longer than that, you may find it harder to balance because there will be more transactions to muddle it. To put it simply, wait too long and it gets messy!

Why You Should Always Balance the Budget the Day Before Payday

Make sure you always balance the budget the day before you get paid again. Zero out your account by sending any unspent money toward your main goal, e.g. debt payoff or savings. Make sure your bank account doesn’t actually hit $0, though. Leave a buffer in there or wait to actually move the money until after you’ve gotten paid again.

Will you need that money to cover your expenses for the next pay period? If so, let the leftover money roll over into the next pay period to cover your expenses. Mark the leftover money as income on your budget for the next payperiod so that your master budget will match your bank account. Only let it roll over to the next pay period if you know you’re going to need it for an upcoming expense.

If this seems like a lot at first, you aren’t alone. Budgeting takes a little practice to figure out. Watch the tutorial below to see all of this in action.

How to Make a Budget on Excel or Google Sheets: Video Tutorial

And that’s it!

I hope you have found this tutorial on how to make a budget helpful and that you’ve downloaded my free budget template on Excel or Google Sheets. It’s a fan favorite that my readers rave about and love and I really enjoy seeing people use it!

If you don’t already, make sure you follow me on Instagram at @easy_budget! I have a tribe of over 93k followers and share tips, inspiration, and education daily.

Do you still have questions about getting a budget started? Please reach out to me in the comments section below!

Did you enjoy this post? Save it to Pinterest for later!

29 Responses

Is there a way to add on a 6th paycheck income per month? Also, is there a way to link the categories under “Track Your Purchases Here” to the categories under “Paycheck Expenses” so that it adds up what you’ve spent in that category? Thank you!

Hey Breanna! Yes, you can add a 6th paycheck per month but I wouldn’t if I were you. Each of the 5 available paycheck sections has several spaces so you can write multiple paychecks in for the same week. So for example, if you get 6 paychecks per month but 2 of them are in the same week, just write them under the same income section. However, if you prefer a 6th box for your own organization, Copy paste one of the sections next to the 5th one. Make sure to check all the formulas in the “total” boxes and make sure they copied over and add them to the monthly summary parts too. For the track your purchases here, there is a way to link them all but I didn’t do it on this sheet because I wanted to keep it simple to understand. There is a way if you want to dig into it, you can add little dropdown menus to the “track your purchases here” section. You may have to do a google search for how to do that! 🙂

Hi, I am so excited about trying your budget spreadsheet – thank you! I’m working on a Mac and do not have excel, I know you suggested using google sheets. I cannot get it to automatically add the numbers like it does in excel. Is there a way to make it do this or no? Thanks so much!

Hi Victoria!

Have you tried refreshing yet?? Also, click the cell that is supposed to have the numbers autofill and make sure a formula shows in that cell (check the little “fx” bar at the top of the menu bar). If no formula shows, it got busted somehow. You should be able to copy and paste the formula from another part of the spreadsheet with the same function or hand type it in. Feel free to send me an email for more specific instructions and I’d love to help ya. Send a pic 😉 [email protected]

Hello!

How would I log any extra $$ from my first pack check and make it roll over to the next week (2nd paycheck wouldn’t be able to cover the weeks expenses) would it mess with my actual monthly income?

Hi Heather! If you roll over money from one week to the next because you’ll need it, just mark the money you’re rolling over from the current pay period as an expense on the current period (to zero it out before you start on the next one), then mark it as income on the next pay period. This will give you a rolling total in the “remaining” box of the second paycheck, but it will make your monthly summary off slightly. 🙂 I’m usually looking at the “remaining” boxes anyways.

Do the expenses tally together from the budget?

Are we able to change the colors and fonts?

Yes! And the expenses do tally up as you add them in, automatically!

Can you add a column in the Track Your Purchases section for the company you purchased the item from? Also, is there a way to split the transaction to have multiple categories for one transaction (like you can do in Every Dollar) or would you just have to create another line for it?

I can’t add another column to track your expenses unfortunately, or it would interfere with the “expense” columns at the top of the spreadsheet! I hope you are able to find a way to write in the company on the expense tracker section. If you want to split the transaction, just type it in as two different transactions and make a note of it if you need to! 🙂

I have been searching for a budget spreadsheet that would work for me and I finally found it! Thank you so much for taking the time and creating this AMAZING spreadsheet.

What would you recommend for someone who buys everything via credit cards and then pays them off each month? Should the budget then focus on paying off last month’s stuff or should I focus on what I’m spending in this pay period even though I won’t actually pay it off until next month? Thank you!

I have a really strong preference for paying off the credit card in the same pay period you’re spending the money on! So say you’re in the first half of January… you spend $506 on your credit card at Walmart, Target, and a bill. Mark it as SPENT on your budget for the first half of January and then pay that card off when you sit down to reconcile your budget before the next payday! That way you’re using the CC essentially as a debit card as closely as possible. I have done this before and I think it’s the best way!

That is brilliant! This month may be difficult, but I can start the new year off with that no problem. Thank you!

I love this budget spreadsheet. I can finally track my sinking funds and envelopes in my budget on one spreadsheet.

Do you have any suggestions for folks who use paychecks 3 & 4 to pay for the mortgage on week 1 of the month? Trying to figure out how to use the spreadsheet that way! Thank you!

I do this too! I set 1/2 the mortgage money aside for each paycheck of the month (we get 2), and then use the money on the 1st of the following month. If you are doing something similar, this should work. First, I put 1/2 the mortgage as an expense for each paycheck. Then, I move the money over into a savings accounts so it’s not cluttering my checking account. I then mark the money as “spent” on the budget spreadsheet. Then, when the payment actually comes out of my account it’s already marked as spent and I don’t have to do anything further. There are a lot of variations of this that would work, hopefully this gives you some ideas on ways you can make it work for you!

Hi Merilee,

Is there a way to a date column for when those monthly debts/payments are auto-drafted from my bank account so I know what to expect and how much I should keep in my debt account?

Hi Courtney! You could try to add a column but it might not be the easiest. What about just writing the date of auto-draft right next to the name of the item, like this… “Car payment – 21st” or “Student loan 2 – 4th” so that you can more easily see when the payments will come out? That’s what I do!

Hi Merilee! What would you recommend to someone who has inconsistent paycheques? I work shift work so each paycheque is slightly different, and have premiums from night shifts/weekends/holidays.

Yes, I still would!! Because you really need to plan out what the money from each individual paycheck is actually going to be paying for. What I would do if I were you is create several paychecks work of budgets at a time (3-4), and estimate how much you will earn, maybe on the low end. And then when you actually get paid and see the real amount, go in and adjust it as needed. Make a plan ahead of time for what you will do with the extra money on high checks (toward debt or savings most likely!). Good luck I hope this helps a lot!

What is the Donut Graph Formula?

% of income that is spent for the month so far. It will reach 100% at the end of the month when all your income is recorded as spent, saved, etc.

Hi Merilee, I love using your template, it was the layout I was looking for. It works perfectly for me, thank you! I was just wondering, at the end of the year, when I start budgeting for the new year, do I just go back to January and reset the months I’ve already used for this year? Or should I copy and create new pages for next year?

Hi Brielle,

I would copy the entire file and create a new one (copy), then rename it for your current year and delete all the old data. Or something along those lines. You will want to keep your previous year’s budget for your records! It’s helpful to look back on. Whatever way is easiest to do this works, just make sure you keep a copy of your past year’s budget.

Merilee