This post may contain affiliate links where I earn a commission, at no additional cost to you, if you decide to make a purchase after clicking on a link. Please see our Disclosure Policy for full details. Thank you for your support!

When I finally got the courage to add up our debt in 2016, it totaled $71,000.

There was a huge pit in my stomach. We were paying $1,300 a month in minimum payments and it was making us broke. I was frustrated, and I didn’t want to continue living paycheck-to-paycheck and stressed out anymore.

I knew we had to change something. I knew that paying off our debt was the only way we could get rid of those massive minimum payments and actually be able to keep our money every month instead of sending it toward our past.

As I dove into debt payoff research, I quickly realized that how we paid off our debt was just as important as why we needed to in the first place! In order to actually tackle this $71,000 of debt, I needed a method that we could stick to, that was motivating, and that wouldn’t drag on forever.

How was my family going to tackle this mountain of debt as fast as possible?

After reading Dave Ramsey’s The Total Money Makeover, we decided that we’d use the Debt Snowball Method to pay off our debt fast. The Debt Snowball Method of debt payoff is exciting, motivating, and the hands-down the best for people who have lots of large debts to pay off!

I’m so glad we did. With the Debt Snowball Method, we were able to pay off all $71k of our debt in less than 3 years on a single income, even with kids! I swear by this method and shout it from the rooftops. It works!

Related reading: How We Paid Off $71k Of Debt in Less Than 3 Years on a Single Income

Let’s dive into all the juicy details on how to pay off debt fast with the debt snowball method!

What is the Debt Snowball Method of Debt Payoff?

Thankfully, the Debt Snowball Method is simple. You begin by listing out all of your debts and ordering them by balance from smallest to largest. Make sure you include all student loans, credit cards, personal loans, medical debt, car loans, phone loans, etc. You do not need to include your mortgage in your debt snowball.

Let’s use this example:

| Debt Name: | Debt Balance: | Monthly Min. Payment: |

| Student Loan | $2,250.42 | $150.00 |

| Credit Card | $7,420.00 | $200.00 |

| Car Loan | $23,224.30 | $320.20 |

| Totals: | $32,894.72 | $670.20 |

After you have a clear picture of what your total debt looks like, you will begin attacking the smallest debt first. In this case, you would attack your student loan first. You do this by using all of your financial power on this single, smallest debt.

Pay just the minimum payments on all your other debts, and throw all extra income and spare money at your smallest debt. Speed up this process by budgeting your money, working side hustles to increase your income, or selling items in your home that you don’t use and putting the money toward this smallest debt.

Over time, this debt will get smaller and smaller, and before you know it, poof! It will be paid-in-full!

Once this debt is paid off, you will move on to the next smallest loan on the list, and repeat the process. In this case, you would start paying on your credit card. Now that you have the student loan paid off, you’ve freed up the $150.00 minimum payment in your monthly budget and that money can now go toward the next smallest debt!

Each month as you focus on your smallest loan, you will throw all the minimum payments from the loans you’ve paid off plus any extra money you can get your hands on at your smallest loan, thus making the debt snowball payment bigger and bigger!

Just like a snowball rolling down a hill and picking up new snow and getting bigger and faster, you’ll get so much momentum doing it this way that it makes your debt payoff exciting and fast!

In this example, after you have paid off the credit card, move on to the car loan, using the $150.00 from the student loan minimum payment and the $200.00 from the credit card minimum payment plus all the extra money you can come up with on the car loan until it’s paid off and you’re completely debt-free.

How the Debt Snowball Method Works Best

In order for this process to work to its full potential, there are a few promises you should consider making to yourself.

The big one is to not add any more debt to what you already have.

If you continue to add debt to your debt total, what’s the point of working so hard to eliminate all your debt? You’ll just have more to work through if you habitually swipe your credit card.

The best thing you can do is vow to stop living a debt lifestyle and focus your entire energy on getting debt out of your life. That means no credit cards, no more loans, no more debt. Period.

The second promise you should consider making to yourself is to start budgeting. I know this is a scary thing for some people, but I promise it is worth doing.

Tell every dollar where to go — give your money a purpose. Make it work for you, not against you. You will be surprised to find that you have much more “wiggle room” with your money when you budget. I have tons of great budgeting resources and free tools! Check them out to get started on a budget.

Related reading: How to Make a Budget: Step-by-Step Guide + FREE Budget Spreadsheet

The third, and final, promise is to keep your “why” in sight.

Paying off debt can be a long road. It’s not something that happens overnight. That is why I call it a debt-free journey. There will be a point where you want to throw your hands up and walk away from the fight.

This is where your “why” comes in! Other than simply having more money, what motivates you to pay off this debt? The debt-free journey gives you permission to dream big.

What is your “why?”

- Do you want to purchase your first home?

- Do you want to be more financially secure before you start a family?

- Do you want to travel the world and have experiences that you couldn’t otherwise afford?

- Do you want to take care of aging parents, pay for your child’s higher education, or start your own business?

- What are your dreams and passions that you could afford if you didn’t have debt?

This is what will get you through paying off your debt and keep you motivated! It’s a challenging journey, so always remember your “why.”

Downfalls of the Debt Snowball Method

The Debt Snowball Method is all about the momentum and the “quick wins” that you get by tackling the smallest debts first. When you pay off that first debt, it’s a rush! The Debt Snowball method is not about what will save you the most money in interest.

When you list your loans from smallest to largest, not accounting for the interest rates on your loans, that means that you may pay more interest in the long-term. The Debt Avalanche Method, where you order your debts from largest interest rate to smallest and tackle them in that order, technically saves you the most money in interest over time.

The Debt Snowball Method may not be your best option if you want to save the most money right now or if you are going to be paying off debt for a longer period of time and have really high interest rates.

However, sometimes paying off debt starting with large, high-interest loans can be off-putting. Without the quick wins of paying off small loans first, some people get frustrated, feel hopeless, or get distracted and give up.

Is The Debt Snowball Method Right For You?

There are many ways to pay off debt. The most important thing is that you have a solid plan that you can stick to!

The Debt Snowball Method is the way that my family paid off $71,000 of debt and took our lives back. We needed the motivation and quick wins in the beginning to fuel the long, grueling loans near the end of our debt payoff journey. Without those quick wins, I’m really not sure that we would have been able to pay off our debt in full.

If you’re mad at that pile of debt you owe, you know your “why,” and you need help staying motivated to get through it as fast as possible, then the Debt Snowball Method is definitely for you.

Don’t worry about paying an extra couple hundred bucks in interest by not tackling your highest interest loans first. In the grand scheme of things, you won’t even notice it! The most important thing is to actually start and finish!

Quick Tip: If you have 1-2 really high-interest loans that are just drowning you with interest (i.e. credit cards at 25% interest), consider paying off your debt in a modified Debt Snowball, custom order type thing. Pay off the 1-2 super high-interest debts first and then proceed with the Debt Snowball Method. We did this and it worked great!

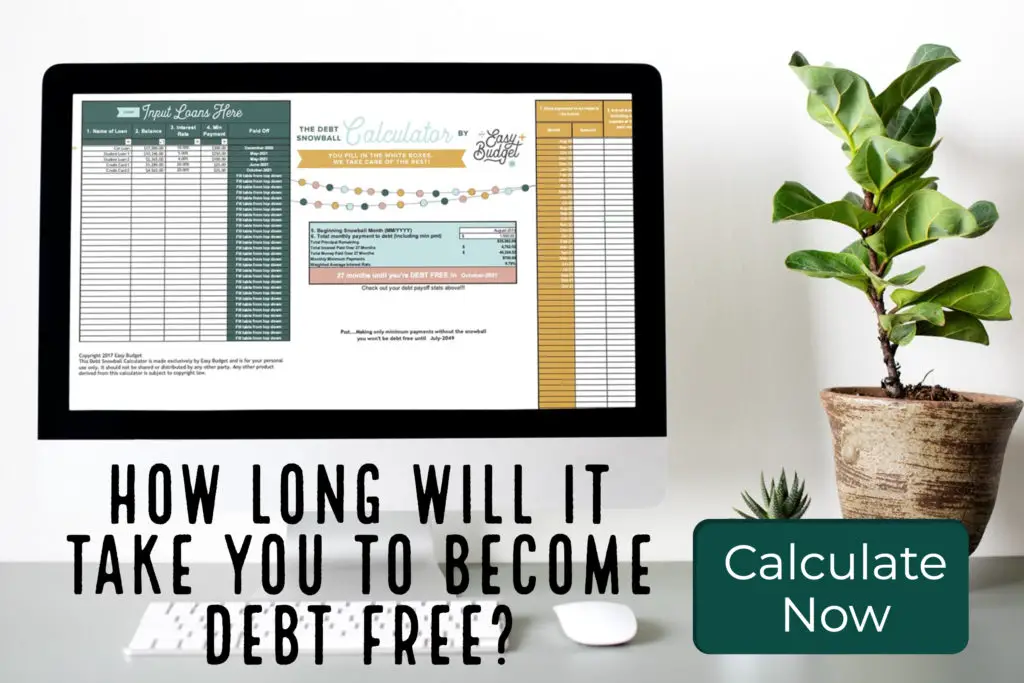

How Soon Can You Be Debt-Free?

When we began our debt-free journey, we couldn’t find anything on the World Wide Web that let us accurately determine how soon we could have all our debt paid off based on how much we could put toward debt now and in the future with our growing income, bonuses, tax returns, and other future lump sum payments that we were planning to make toward our debt.

So what did we do? We created something!

Easy Budget Debt Snowball Calculator

Whether you’re using the Debt Snowball Method, the Debt Avalanche Method, or a custom order, our Debt Snowball Calculator is fully automated. This calculator is user friendly, has space for us to 35 loans and you can play around with different scenarios to see how they will affect your projected payoff date.

The best part about the Debt Snowball method is that it is easy and anyone can do it! Trust me, if we can use the Debt Snowball Method to pay off debt, so can you! In August 2019, we made our final payment to debt. Now we are completely debt-free and enjoying so much peace and freedom. This method is tried and true, and can change your life just like it changed ours.

The best part about this process is that after you pay off all of your debt, you can use your money to work for your future and not your past. From the example above, you can use that $670.20 to save for an emergency fund, a new-to-you car, or a vacation!

You can do anything with your money when you don’t owe any to anyone!

Do you think the Debt Snowball Method will work for you?

Please let me know in the comments below. Have any questions? Reach out! I love to chat!

Did you enjoy this post? Save it to Pinterest for later!