This post may contain affiliate links where I earn a commission, at no additional cost to you, if you decide to make a purchase after clicking on a link. Please see our Disclosure Policy for full details. Thank you for your support!

Looking to pay off your credit cards but wondering how long it will take you? With a few or even a bunch of credit cards at varying interest rates – 8%, 20%, 33% – always working against you, how long will it take you to become credit card debt-free? Today, I’ll share with you the best tool for calculating your credit card payoff.

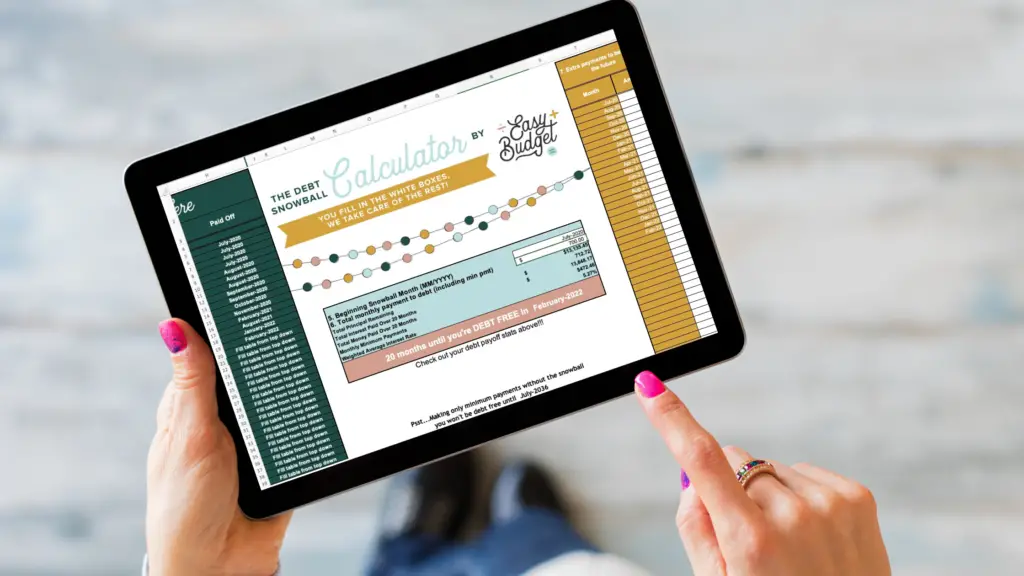

The Easy Budget Debt Snowball Calculator is an Excel Spreadsheet tool (also compatible with Google Sheets) we created years ago to calculate our own debt-payoff. We wanted to have an end in sight before we started making all the sacrifices that debt payoff requires.

Use this tool to help you calculate your credit card debt-free date in about 5-10 minutes.

The best part about this tool is the customization you can build in in just seconds.

This Debt Snowball Calculator can handle variable income, extra payments to debt in the future, and up to 32 different loans.

Don’t plan to use the debt snowball method exactly? No problem. You can enter your debts in the order you plan to pay them off, and it will calculate your payoff date using your custom order. You can also switch to the debt avalanche method in one click!

Related reading: How to Pay Off Debt Fast With The Debt Snowball Method

This is the perfect tool for those following Dave Ramsey or treading their own unique path to debt-freedom. We did a little bit of both on our journey!

How to Get Started

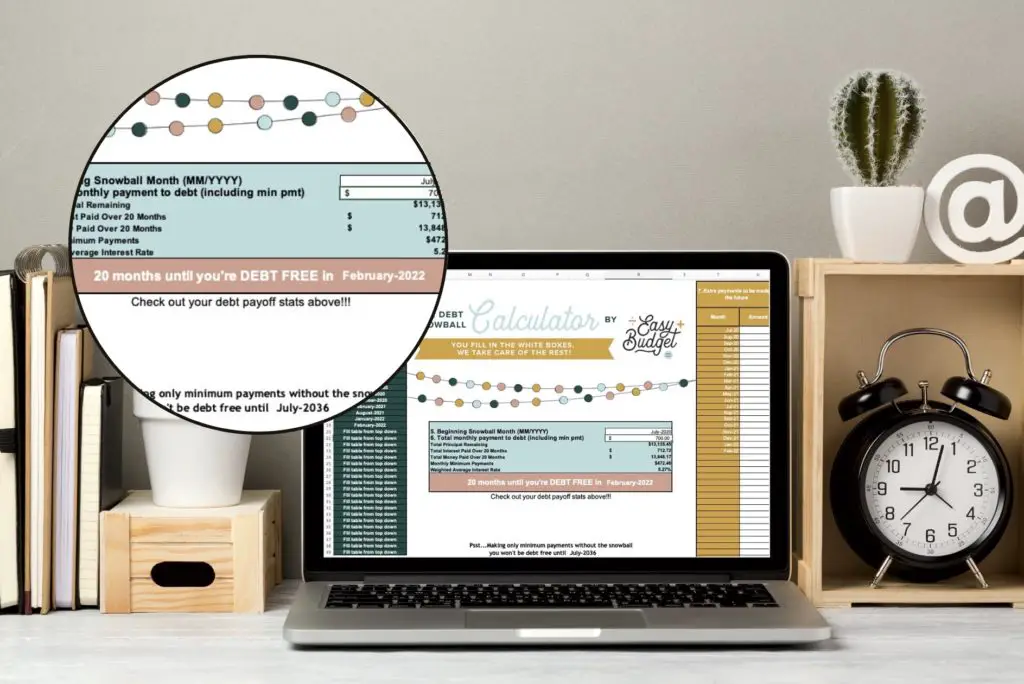

1. Download the spreadsheet and open it up on Excel or Google Sheets.

2. Start by entering in all your credit cards and other debts. You’ll need your interest rate, minimum payment, and current balance.

3. Then enter the start date of your debt snowball and how much you plan to pay toward your cards every month, including the minimum payments (whatever amount you plan to pay consistently).

4. Last, enter in any extra payments to be made to debt in the future on top of the set amount you plan to pay every month.

And voila! You debt-free date will auto-calculate and show!

Related reading: How We Paid Off $71k of Debt in Less Than 3 Years on a Single Income

Calculating your credit card payoff is quick and easy with this tool!

Click to learn more, see a full video tutorial, and grab your copy.

Did you enjoy this post? Pin it to Pinterest for later!