This post may contain affiliate links where I earn a commission, at no additional cost to you, if you decide to make a purchase after clicking on a link. Please see our Disclosure Policy for full details. Thank you for your support!

Are you thinking about paying off your debt, but hoping to get a good idea of how long it will take before you begin? Paying off debt is hard. Having an end in sight, some light at the end of the tunnel, would be amazing. If so, I have the best Debt Snowball Calculator Spreadsheet for the job.

4 years ago when my family first set out to pay off out $71,000 of debt, we were determined to do it as quickly as possible. We were going to have to make some big sacrifices and budget like crazy. Before we began, I wanted to know how long it would take.

How long would we have to pinch pennies and say “no” to all the fun and extras?

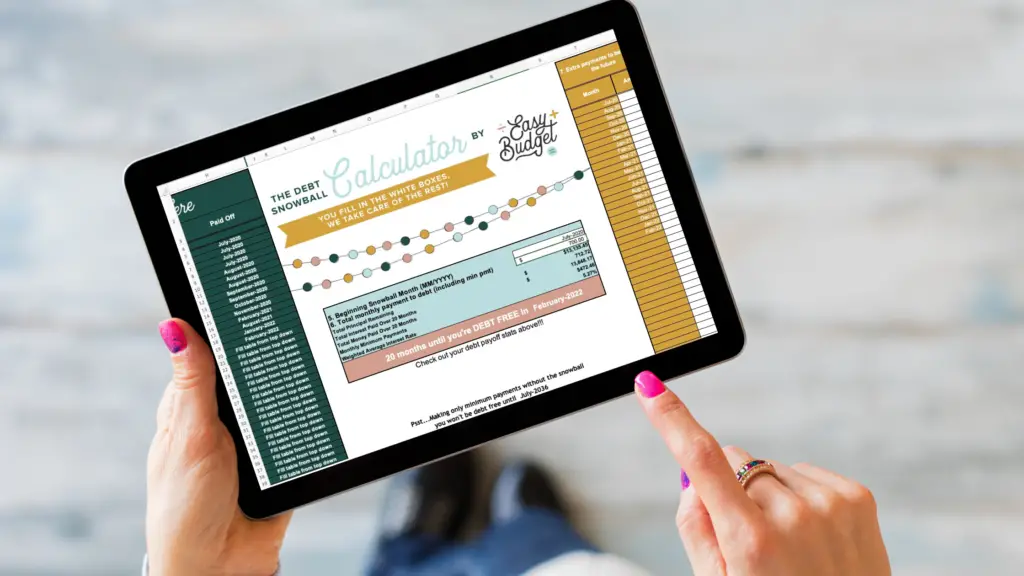

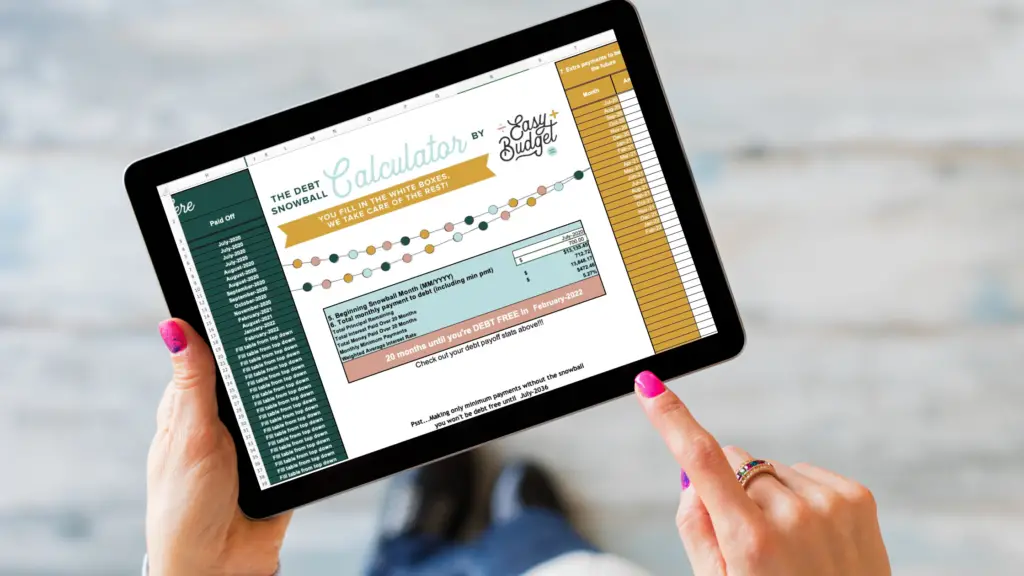

My engineer husband created the Easy Budget Debt Snowball Calculator for our personal use, and since then it’s been used by over 4,000 others to boost their journey to debt freedom!

What is the Easy Budget Debt Snowball Calculator?

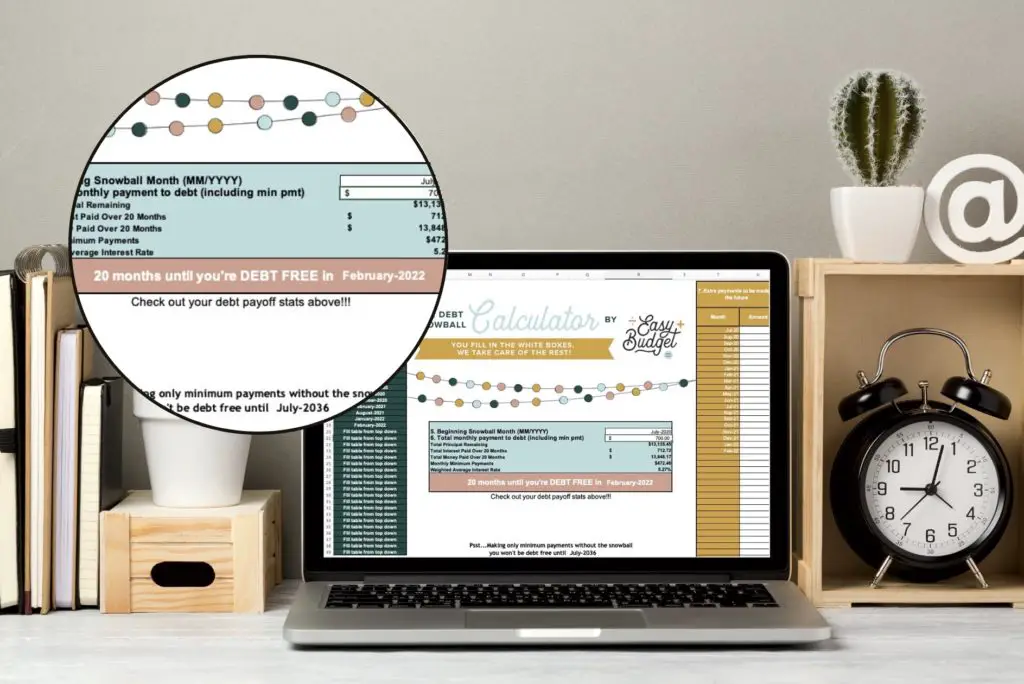

The Easy Budget Debt Snowball Calculator is an Excel spreadsheet that is designed to help you plan your debt payoff and calculate your debt-free date. You can also upload the spreadsheet to Google Sheets and use it there.

Unlike some of the free calculators online, this tool is fully customizable so you can easily add extra payments to be made in the future, account for 32+ loans, and enter your loans in a custom payoff order.

Basically, it’s the premium option for those who are serious about paying off debt and looking to make a real plan and set some clear goals to increase their success, motivation, and consistency.

Amazing Debt Snowball Calculator Spreadsheet Features:

- Easily play around with different payoff scenarios

- Switch between debt snowball, debt avalanche, or custom order

- Enter extra payments to be made in the future (bonuses, tax refunds, etc.)

- Enter future increases to your debt payoff (e.g. raise at work)

- Calculates automatically

- Excel and Google Sheets Compatible

This tool will allow you to plan out your entire debt payoff plan in just a few minutes.

How much debt will you put toward debt each month? When and how often will you make one-time big extra payments toward your debt? Will you be getting a raise later and putting that extra cash toward your debt? How much interest is piling up against you every month and how much will it slow you down?

This calculator can handle all of that.

It will help you come up with a goal debt-free date. Then, you’ll know exactly how much debt you need to pay off every month to become debt-free by your goal date!

These hard numbers will motivate you and give you a clear path to follow.

Using this tool, we were able to pay off $71,000 of debt in less than 3 years with a single income, and yep, we’ve got kids! It actually took longer than planned, but it’s not because we calculated wrong, we just had some life things happen. That’s okay though, we still reached our goal of becoming debt-free and are enjoying the freedom and benefits now!

Related reading: How We Paid Off $71k of Debt in Less Than 3 Years on a Single Income

Without an end in sight and a monthly goal of debt to pay off, I think we would have given up during those tough months when unexpected things were coming up.

Instead, we just recalculated, got back on the horse and kept moving forward! We had a new goal, and kept working toward it until we achieved it.

Who This Debt Snowball Calculator Spreadsheet is For

Got debt? Trying to pay it off and make a plan?

This calculator works perfect with Dave Ramsey ideology, or paying off debt with the Debt Snowball Method. However, you can also use this Debt Snowball Spreadsheet to calculate paying off your debt in debt avalanche order (highest interest rate first), or even a custom order (e.g. pay off your high interest credit cards first, then debt snowball for the rest).

Better yet, with this calculator, it’s easy to switch between methods and compare your payoff amount and timeline to decide what is best for your family.

Related reading: How to Pay Off Debt Fast With the Debt Snowball Method

Check Out This Quick Video Tutorial to See How it Works:

What Our 4,000+ Customers Are Saying

If you’ve read this far, you probably want to know if this tool is actually everything I’m saying it is. So don’t take it from me, read the reviews of some of our 4000+ customers:

“Great purchase! This will give me the motivation I need to pay off all my debt over the next 2 years!” -Jennifer H.

“Easy to use. Great to see everything laid out in front of you to be able to make a plan!”-Sarah M.

“This is a must buy to become gazelle intense! Super easy to use. Gives you a visual to keep you motivated in your debt free journey.” -Candice M.

“This debt calculator is so helpful, it is really helping me put our debt in perspective and see how much I really need to put towards my snowball each month, I can’t wait to update and watch my debt go down.” -Mandy B.

“I love the layout and simplicity of your Debt Snowball Calculator and the tutorial that explains so easily how to use the Debt Snowball Calculator. Can’t wait to use this every month to stay on track!!!” -Kelly B.

A special deal for you!

Would this debt snowball calculator help you solidify your own debt-free plan?

If so, I have a special gift for you! As a thank you for hopping on this page, you can get the Debt Snowball Calculator for just $12 instead of the retail price of $16.99. Click below to snag yours and take your debt-free journey to the next level!

Get your own Debt Snowball Calculator for $12.00 here

Do you have any questions about this Debt Snowball Calculator Excel Spreadsheet? If so, ask in the comments below and I’ll get back to you right away.

Good luck kicking debt’s butt!

Did you enjoy this post? Pin it to Pinterest for later!

2 Responses

I’ve downloaded the snowball calculator and placed the appropriate information and the date starting the calculator, but the dates have not populated in the columns to the right to show the progress with dates – what have I done incorrectly?

Hi Sherry! Are you using Google Sheets or Excel? If you are using Google Sheets make sure you refresh often! If that doesn’t work or you are using Excel, send me your copy at [email protected] and I will check it out ASAP!