THE EASY BUDGET

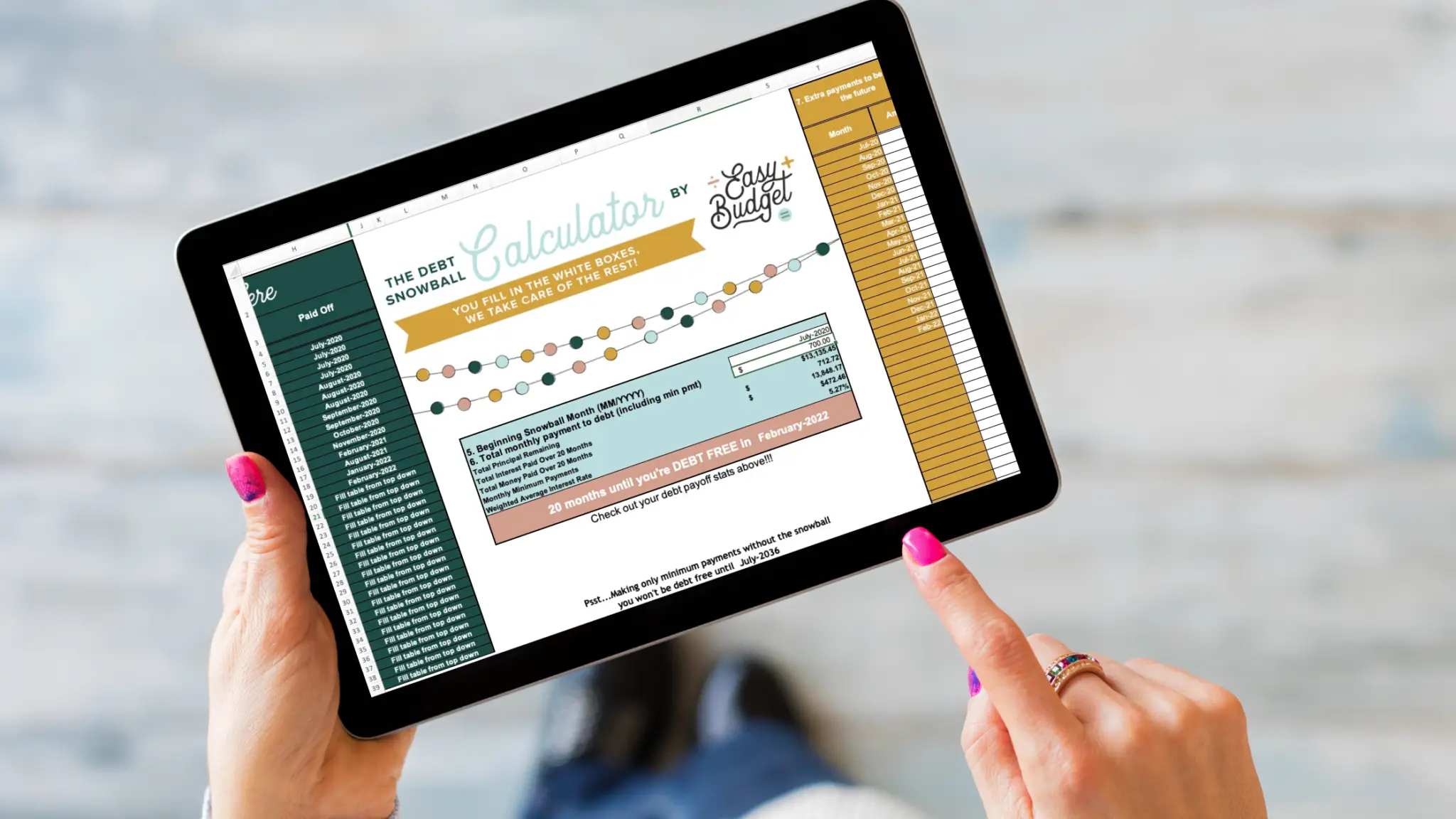

Debt Snowball Calculator

$16.99

NOTE: This is a digitally downloaded product.

Let me guess . . . You have a lot of debt? Student loans, credit cards, car loans . . . it can be overwhelming!

You know you need to pay it off, but before you get started, you want to know how long it’s going to take…

Great news! Our Debt Snowball Calculator helps you to…

- Pinpoint the exact month you can be debt-free to help you stay target-focused

- Play around with different paydown scenarios to formulate the perfect plan for your your situation

- Include future lump sum payments like bonuses, tax returns, and leftover grocery cash so you can watch your debt-free date get closer and closer with larger payments

- Easily adjust payoff dates with lifestyle or income changes, helping you keep at it no matter what life throws your way

- Help your spouse or family see the power of an aggressive payoff plan so you can be on the same page

We created the Easy Budget Debt Snowball Calculator because we couldn’t find anything on the internet that let us calculate our debt-free date based on how much we could put toward debt now and in the future with our growing income, bonuses, tax returns, and other future lump sum payments. We’ve got you. Ours can totally do that!

NOTE: This tool works best with Excel, but can also be used with Google Sheets.

To open in Google Sheets, download and save the file to your computer without opening it. Open Google Sheets. In the upper right quadrant, select the Manila folder icon to “upload file”. Refresh often to see calculations.

Get out of debt FAST! Our Debt Snowball Calculator allows you to create a fully customized, simple debt payoff plan that keeps you motivated and informed!

+ User friendly

+ Fully automated (you fill in the white boxes, everything else will auto calculate!)

+ Input your loans once and update with actual payments as they are made

+ Space for up to 35 different loans

+ Change and play around with several variables to see how it affects your payoff date

+ Clearly displays your debt stats

+ Clearly displays debt payoff month and year (will show all calculations on separate page)

+ Perfect for irregular income

+ Easy switch to Debt Avalanche method (highest interest rate first) or custom order

+ Input for one-time lump sum payments on debt (bonuses, tax refunds etc.)

+ Input for expected increases in monthly debt payments (future raises, second job etc.)

+ Get 15% off this item when you bundle it with the 8-in-1 Personal Finance SuperSpreadsheet. Add both to cart and use code BUNDLE15 for discount.

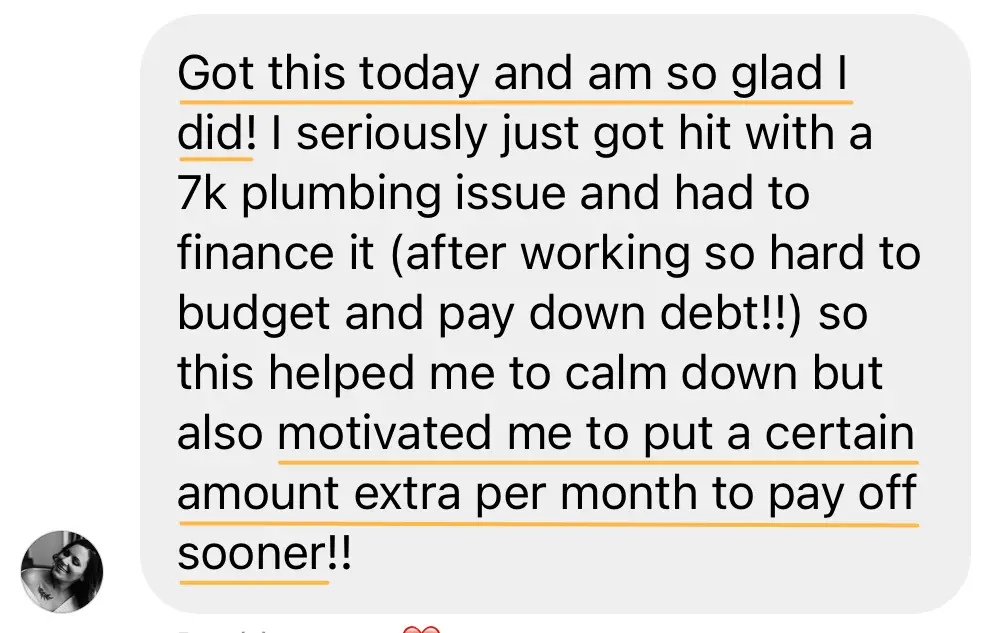

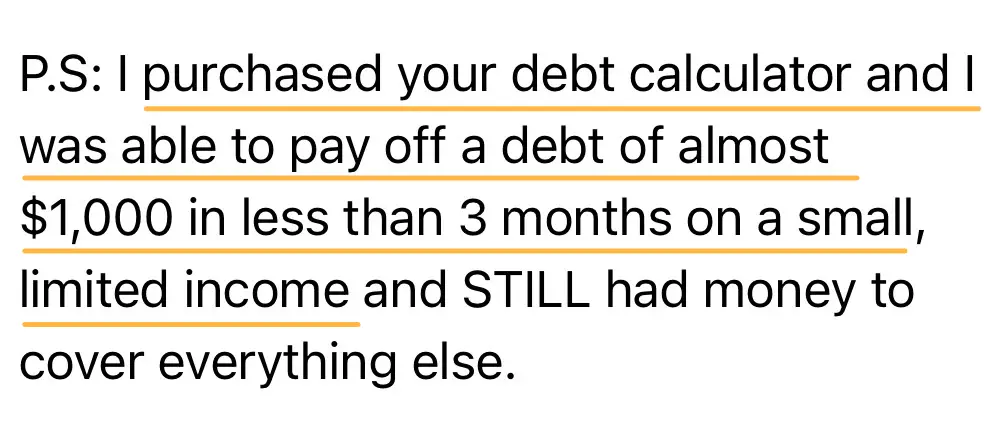

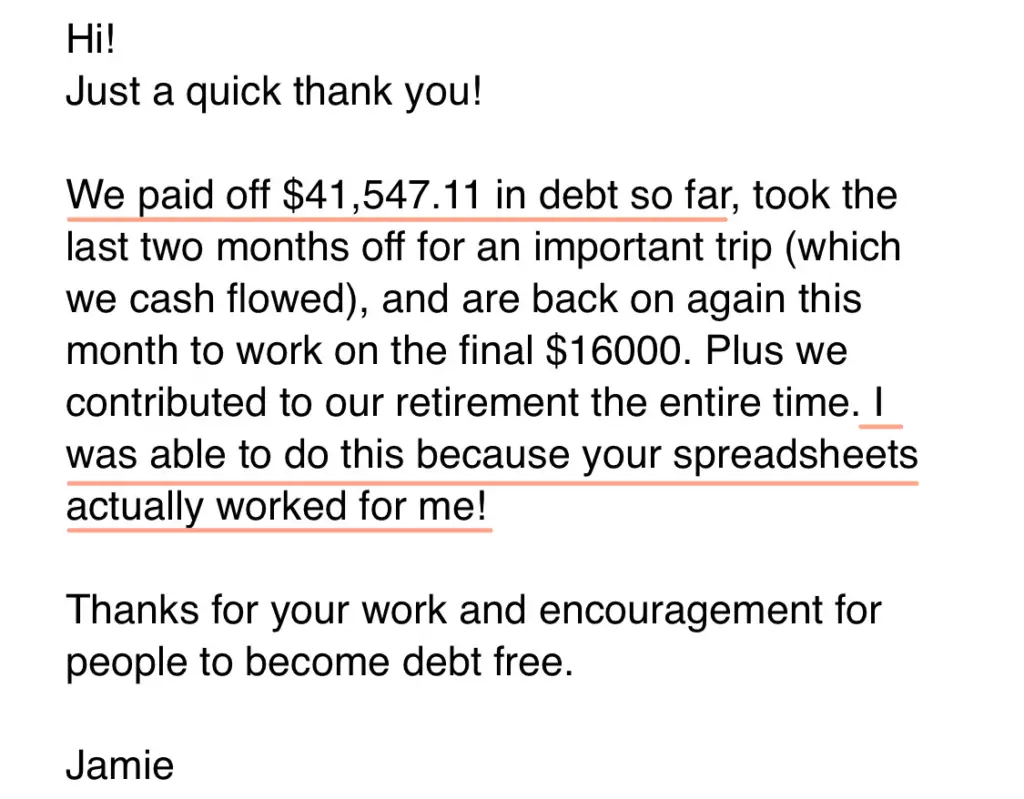

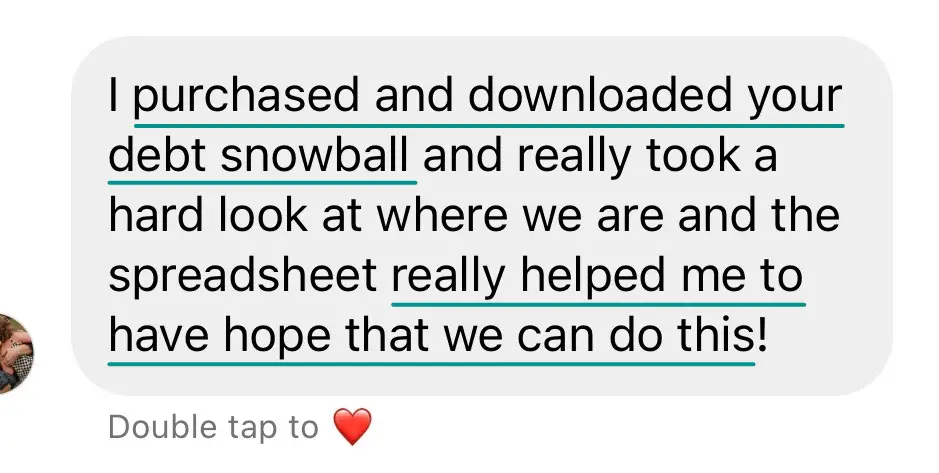

I love how easy the spreadsheet is to navigate and update!

My only complaint is I can’t make it bigger on the spreadsheet.