This post may contain affiliate links where I earn a commission, at no additional cost to you, if you decide to make a purchase after clicking on a link. Please see our Disclosure Policy for full details. Thank you for your support!

Hey there! Does this describe you?

+ You have debt

+ You’re intrigued about going on a debt-free journey

+ You’re not quite ready to tackle it yet

If so, this list is for you! There are many easy things you can be doing now to prepare yourself to pay off debt before you ever send an extra penny. This is an excellent place to start to get your feet wet before you dive in!

Your Pre Debt-Free Journey Checklist

Gain Knowledge

▢ Read or listen to the book Total Money Makeover by Dave Ramsey, it’s probably the most popular guidebook to becoming debt-free in the world, and it’s a must read

▢ Watch the Dave Ramsey show on YouTube (you can also tune in on Facebook, the podcast, or daily radio show)

▢ Read 1-2 additional books or listen to podcasts related to personal finance (I enjoyed Smart Couples Finish Rich by David Bach, and a couple podcasts I enjoy are Choose FI and the Dave Ramsey Show)

Learn Essential Skills

▢ Research what a zero-based budget is. This is the only way to budget and all it means is you plan every single dollar on paper before the month starts! Learn more here.

▢ Create a budget. If you need a little help, I can teach you how to make one, click here to read my instructions and download the FREE template I use! (This is the hardest step but it’s the most essential!)

Get Motivated

▢ Find a friend you can talk to when you need support (the #debtfreecommunity on Instagram is awesome support group if you need one!)

▢ Watch the Dave Ramsey show, it’s incredibly motivating and watching a few episodes always kicked my butt into gear and got me excited!

Make a Plan

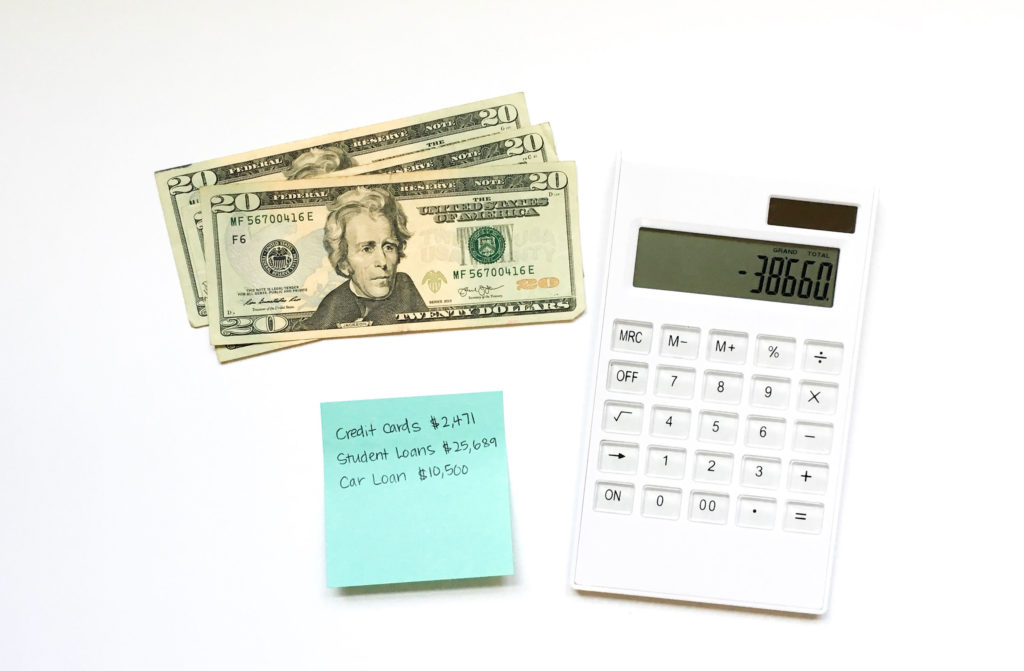

▢ List all your debts on a piece of paper. You have to face the truth of your situation. Include the balances, interest rates, and minimum payments.

▢ Use your budget to determine how much extra you have after all expenses are paid that can be sent to debt each month. If you don’t have any extra, you need to trim back your budget, increase your income, or both. Set this amount as your monthly goal!

▢ Determine how long it will take to pay your debt off. Estimating will work, but if you prefer a more precise payoff date, we have a popular tool that can calculate that for you in about 10 minutes!

Get Going!

Now it’s time to use that plan you made and get going! Get started ASAP! You won’t know everything before you start paying off your debt. It’s a journey and you will learn so much along the way.

If you feel totally overwhelmed, just start with one thing that feels do-able! Don’t get frozen by to-dos!

Think about how much better your life is going to be when you no longer have to throw all of your hard-earned cash into someone else’s pocket every month! Think of everything you’ll be able do when your money is yours to keep forever!

We are just days away from completing our own $71,000 debt-free journey, so I know it can be done. It’s not easy, but it will be so worth it. I hope you will get started today!

Need more help? Check out these related articles:

The 7 Steps to Paying off Big Debt

What to Include in a Bare Bones Budget