This post may contain affiliate links where I earn a commission, at no additional cost to you, if you decide to make a purchase after clicking on a link. Please see our Disclosure Policy for full details. Thank you for your support!

Has budgeting always been a struggle for you? With this zero-based budget template you’ll be budgeting more efficiently and consistently than ever before! This easy-to-use Excel spreadsheet budget will help you will increase your monthly savings, pay the bills on time, and begin to pay off debt paycheck after paycheck. If this is something you need, then keep reading and grab your FREE download below!

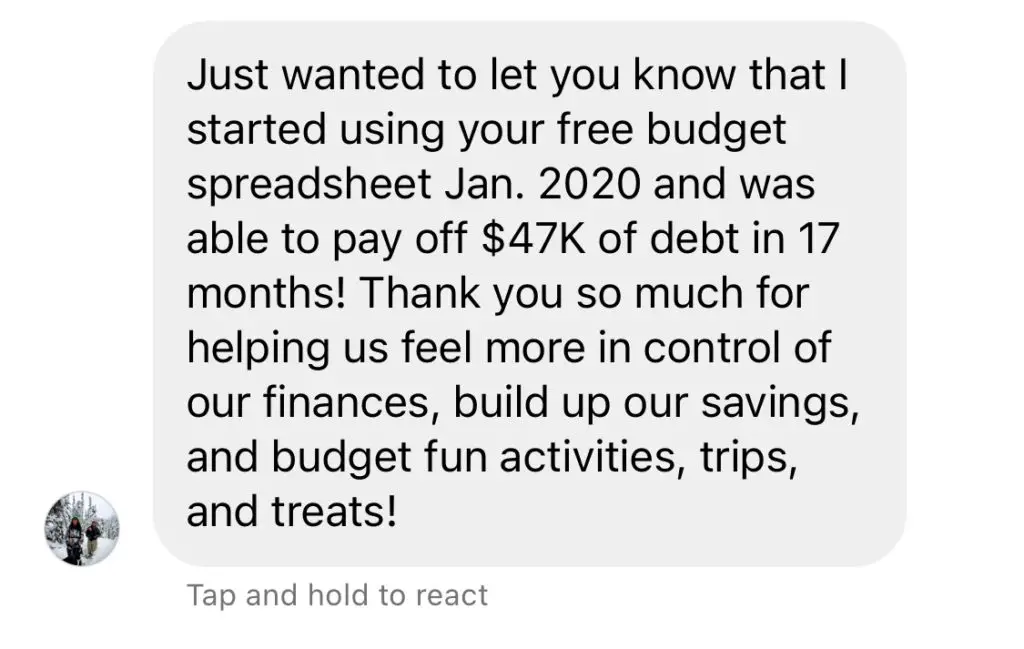

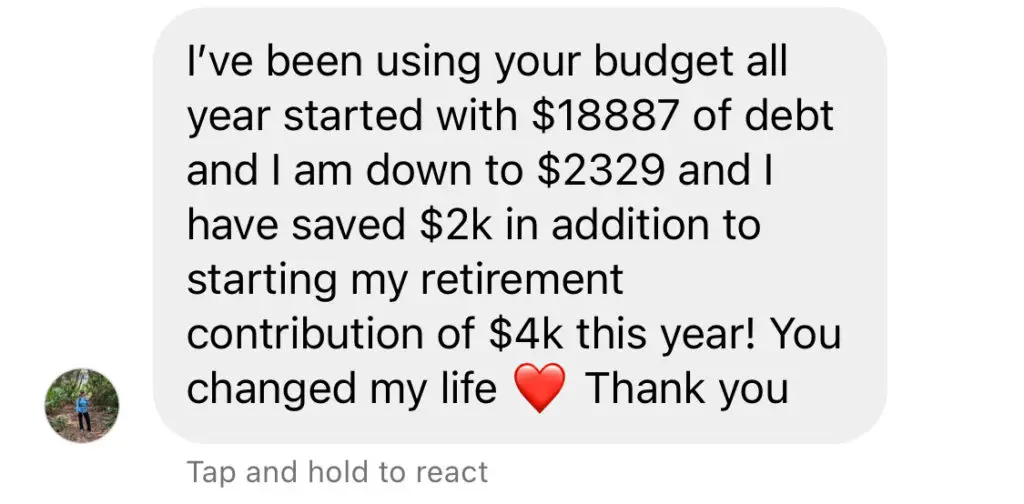

This Excel template has been downloaded over 40,000 times, and I get emails every day from folks telling me how much they love it! See for yourself!

Download your FREE Excel budget template here! Yes, it’s FREE!

View the video tutorial below.

What is Zero-Based Budgeting?

A Zero-Based Budget is a budgeting method where you make a plan for all of the money you make and spend for a certain time period. Typically this means you will make a plan for every dollar you earn from each paycheck.

Simply put, with a zero-based budget, every dollar you earn needs to have a purpose and a plan until $0 are left unbudgeted.

A zero-based budget differs from other traditional budgeting tools because instead of beginning by brainstorming how much you should spend on bills, groceries, and gas, you begin with the amount of your income and then start planning out how you’ll spend each dollar from there. The concept “zero-based” says that every time you start a new pay period you will need to analyze and justify every expense.

Takeaways:

- Great for individuals and families

- Very effective at helping you make fast progress

- Every dollar of your income gets budgeted until $0 remains

- The aim is to allocate every paycheck somewhere, including savings, debt payoff, or retirement

Let’s Bust a Myth!

There’s a common myth about Zero-based budgeting that causes some people to be afraid to try it.

The myth is that since you are budgeting every dollar, your bank account will reach $0 and be left vulnerable to surprise charges, overdrafts, and basically being penniless.

This is a MYTH!

With this method, you never want your bank account to reach $0! You simply want every dollar you earn to have a purpose and be budgeted until $0 remains unplanned.

Remember, this includes putting money toward savings, debt payoff, investing, and so on- so your money goals are being met!

It’s true, however, that every dollar will need to be sent somewhere. So how do you avoid your bank account reaching $0?

Here are 2 effective ways to prevent your bank account from reaching $0 with a zero-based budget:

- Leave a $100-$200 buffer in your checking account that acts as your “$0”

- Wait to send money to your “extra goals” (savings, debt payoff, extra investments) until the end of the pay period so you’re sure all your needs are met and you don’t run out of money. It will act as your buffer. Once your checking account has been replenished with a new paycheck, move this extra money to your “extra goals.”

How Does this Excel Template Work?

This zero-based budget template is divided into three main categories; “Paycheck Income”, “Paycheck Expenses”, and a “Track your purchases here” section. The template has 5 different sections with these included, giving you room to budget anywhere from 1-5+ paychecks per month with ease!

With this template you can easily budget your weekly, biweekly, 2x monthly, or monthly income . . . or any combination of these pay schedules, and budget every dollar!

In addition, there is also a monthly summary section with a graphic that allows you to visually track how much money you have spent and how much you have left within the month.

The goal of this type of budget is to link all of your income to specific expenses, such as rent, bills, but also savings, debt payoff or investments.

Download your FREE Excel budget template here to get started on it!

You can view a video tutorial here.

Zero-Based Budgeting Vs. Traditional Budgeting

The main difference is that with traditional budgeting, you would set a limit for yourself on how much to spend on groceries, gas, and bills and try to stick to that. With zero-budgeting, start with your income from each paycheck and plot out which bills it will pay for, how much you can afford for groceries and other variable expenses, and then see if there’s any room for saving, debt payoff, and investing until $0 are left unplanned.

For example, with traditional budgeting if you were to budget $500 for groceries and end up spending $480, the extra $20 would likely just sit in your bank account with no purpose. You stayed within budget, yay! Goal met, right?

With zero-based budgeting, wrong!

You would then take that extra $20 that you didn’t spend on groceries (hooray for spending less than planned!) and put it toward something specific. Every dollar needs a goal and a purpose! If it doesn’t get spent on groceries, perhaps it will go directly toward debt payoff, or savings. Or perhaps you spent more than planned in another budget category, and you could use it there. You would then take that $20 and reallocate it toward a new goal so that every dollar has a name and a plan!

Advantages

Zero-based budgeting allows for superior spending intentionality, easily cutting out unnecessary spending, reaching financial goals quickly, and more budget flexibility. When every penny spent goes through an analysis decision, you have more control of your finances.

With this method you can also increase your debt payoff, investments, and savings because you reign in all unnecessary spending that doesn’t align with your long-term goals. It’s more flexible than traditional budgeting, as it allows you to focus on different sectors of your expenses to accommodate your needs in different periods.

Disadvantages

Zero-Based budgeting might not be appropriate for all budgeting situations.

If you lead a busy life, this method might not be adequate as it is more time consuming and it takes both planning and consistency. If it takes too much of your time and depending on your situation, this method might not work well for you.

What to do Before Starting

Both your income and your expenses might change every month or every period, so before starting to budget you need to determine your income, expenses, and come up with some categories.

Your Income

Even if your income comes from different sources at different times, with this Excel budget spreadsheet, you can input your earnings as they come and the spreadsheet will adjust as you add new numbers. Make sure you add all types of income, such as:

Main Income

- Salary

- Bonuses

- Side jobs

- Child support

Passive Income

- Investments

- Bonuses

- Royalties

- Rental Properties

Both of these two parameters can be altered as the period occurs, as your income hits your bank account if it varies.

Your Expenses

Bills and other expenses come at different times during the period, so it is important to add them to the spreadsheet each pay period, so you have a better idea of where you are standing financially. Here are a few common expenses:

Fixed Expenses

- Rent or mortgage

- Utilities

- Electricity

- Subscriptions

- Car payment

- Credit card payments

- Student loan payments

- Gym membership

Variable Expenses

- Groceries

- Gas

- Restaurants

- Personal Spending money

Other Expenses

- Childcare

- Lawn care

- etc.

Read Next: 22 Essential Budget Categories to Include in Your Budget

Zero-Based budgeting might be time-consuming but it has many advantages that can help you spend more wisely and help you budget your income every month, week, or pay period. And with this zero-based budget template, you’ll be ready to succeed fast!

This spreadsheet is designed to accommodate any pay schedule, and you can adapt it each pay period as needed, making it the most flexible and amazing zero-based budget template that you can get for absolutely free!

One Response

Hi Merilee, thanks for this article!

Good point about advantages of the zero-based budget. As you say – when every penny or dollar serves a purpose eg. you are thoughtful about where it gets spent, it’s easier to reach your financial goals quicker – so long as you’re disciplined!

Great idea with setting aside $100 or $200 extra as your ‘zero’ – this might relieve the stress and anxiety of having literally $0 left in your bank account – and over time, this extra money will add up if you save it after you’ve paid all of your bills.

What are your thoughts on zero-based budgeting apps – are they better than templates?

– Jani, Frugal Fun Finance