This post may contain affiliate links where I earn a commission, at no additional cost to you, if you decide to make a purchase after clicking on a link. Please see our Disclosure Policy for full details. Thank you for your support!

If you are a parent, you likely want to do everything you can to prepare your kids for their future. You want them to find joy, create lasting relationships, get a great education, and be financially successful. Investing for your kids’ future is one of the best ways to set them up for success!

Putting money aside for your children is a great way to prepare them for their future. Every aspect of their life will be impacted by money, so setting them up for financial success is doing them a huge favor! You can also teach them valuable lessons about managing their finances so they will be prepared to spend the money you are investing for them now wisely when they inherit the accounts or start accessing the funds.

When it comes to investing for your kids, there are several great ways to get started. If you’re ready to start investing for your kids, this article will show you the four best ways to start investing for your kids’ future.

Whether you want to invest for your kids by opening a custodial Roth IRA account, a custodial UTMA (Uniform Transfer to Minors Act) account, a custodial UGMA (Uniform Gifts to Minors Act) account, or a taxable brokerage account, make sure that you are debt-free and have a well-funded emergency fund before you start investing for your kids.

You can’t pour from an empty cup, so prioritize your own finances and retirement funding before you move on to helping your kids with their future.

NOTE: Besides a 529, all the other investment accounts suggested in this article can be opened through popular investment companies such as Fidelity, Vanguard, Charles Schwab, Edward Jones, and so on.

All of them are reputable companies to open investment accounts through, but for the sake of this article I have linked out to Fidelity to make things simple. If you already have a retirement account with any of the above listed companies, you may consider opening your investment accounts for your child with the same one just to keep things easy to manage!

This article is not sponsored by any of these companies or any other source.

The 4 Best Ways to Start Investing for Your Kids’ Future

1. Open a Uniform Transfers to Minor Act (UTMA) account or a Uniform Gifts to Minor Act (UTMA) account to invest for your kids

As a parent or grandparent, you can open a custodial UTMA (Uniform Transfer to Minors Act) account or a custodial UGMA (Uniform Gifts to Minors Act) account in your child’s or grandchild’s name through a bank or brokerage company to put aside money in this account for his/her future. You can transfer the UTMA/UGMA account when your child or grandchild reaches a specific age – typically 18 to 21 years old, depending on the state laws.

As the custodian of the account, you will have full control of the account until your child is old enough to take ownership of the account. After a certain age, your child owns the account and the money in the account.

There are no contribution limits on your UGMA/UTMA account, but only certain amounts will be tax advantaged. A single parent can contribute up to $15,000 per year while married couples can contribute up to $30,000 per year to a UTMA/UGMA account free of gift tax for the 2020 and 2021 tax years. While an UGMA/UTMA account is often used to save for college, your kids can use the funds in the account for anything.

You can invest in only financial assets through a UGMA account, while a UTMA account allows you to invest in any kind of tangible or intangible asset (e.g. intellectual property, good will, etc.).

Once the money is in the account, you can choose investments and let it start to grow for your child over time!

Open a UGMA/UTMA for your child here

2. Open a 529 plan to save for college and qualified educational expenses tax-free

Investing in a 529 plan is a straightforward way to start saving for college on behalf of your kids. Even though many families use the funds for college, you can withdraw the money from the account at any time for qualified higher education expenses or even tuition for private elementary/middle/high school without incurring federal or state taxes and penalties.

A 529 plan allows you to save for the future education costs of your child by making tax-advantaged contributions toward a qualified tuition plan. Single parents can contribute up to $75,000 per year, while married couples can contribute up to $150,000 per year.

Your contributions in a 529 account grow tax-free, and can be withdrawn tax-free for qualified educational expenses like tuition, fees, room and board and textbooks, among other typical college expenses. You can also use the funds to cover other education expenses such as apprenticeships, trade schools, and private elementary or secondary school tuition, and to help pay off your student loans.

If you make withdrawals of your funds for a non qualified expense (aka something other than your child’s education and related expenses), you will pay taxes and a 10% penalty on the investment gains.

There are two types of 529 plans: college savings plans and prepaid tuition plans.

A 529 college savings plan lets a parent save for his/her kids’ future qualified higher education expenses such as tuition, mandatory fees, room and board and textbooks. 529 college savings plans are available in all states.

529 prepaid tuition plans are not available in every state. A 529 prepaid tuition plan lets a parent invest in units or credits of a college or university his/her child is attending for future tuition and mandatory fees at current tuition prices.

The money you put in a 529 account will be invested (you’ll need to choose some simple investments through your account settings) and start to grow for your child.

Open a 529 account for your child here (and browse the best plans)

3. Open a Custodial Roth IRA account to invest for your kids

One of the best ways to start investing for your kids’ future is to open a Roth IRA on behalf of your child. You control the account until your child turns age 18, 19, or 21 (depending on state laws) and then he/she will take over the account.

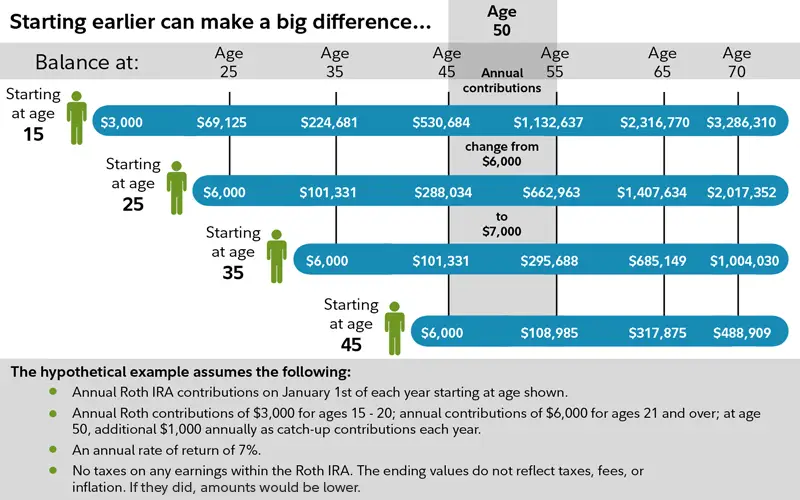

A Custodial Roth IRA is a tax-advantaged retirement account that allows you to make contributions with after-tax dollars (pay taxes now), with total contributions for 2020 limited to your child’s earned income or $6,000, whichever is less. Yes, you read that right- your child must earn the income (or have earned income to report). If your child is too young to work or doesn’t have any earnings to report, you can’t invest funds on their behalf. However, if your child is a babysitter or a Youtube star and starts earning income from a young age, or gets their first job at age 15 and starts earning income, you can begin contributing to a Custodial Roth IRA on their behalf.

You can invest in just about anything in your IRA, with the exception of life insurance and collectibles.

Your contributions in a Roth IRA grow tax-free and can be withdrawn at any time with no tax or penalty because you already paid taxes on your contributions on the front end!

If you are 59½ and your Roth IRA account is at least five years old, your contributions and earnings can be withdrawn with no tax or penalty. But If you withdraw earnings before 59½ or your account is less than five years old, typically you pay taxes and a 10% penalty on your earnings (aka the growth), with a few exceptions like college expenses, first-time home purchases, etc.

However, you can withdraw your original contributions at any time, for any purpose, without paying taxes or penalties.

Open a Custodial Roth IRA account for your child here.

4. Open a taxable brokerage account to invest on behalf of your kids

A straightforward way to start investing for your kids’ future is to open a taxable brokerage account with a reputable brokerage company. You can then invest in various securities such as stocks, ETFs, mutual funds, and bonds.

Related reading: Do You Know These 23 Beginner Investing Terms?

A taxable brokerage account is just a regular investment account the doesn’t have any particular tax advantages like some of the others mentioned on this list. Many times, people will max out their tax-advantaged accounts and then if they have additional funds to invest they will move on to a regular taxable brokerage account to start investing. You will pay taxes on the gains in your taxable brokerage account.

Opening a brokerage account is a great way to invest for your kids if you are not planning to touch your money for five years or more. This is because the securities you choose to invest in may lose some value in the short-term, but may provide a higher returns on your investments over the long term. So think long-term!

The idea behind opening a regular taxable brokerage account for your kids is this: It’s your account, not theirs. Over time it will grow and increase in value and grow your wealth. Then eventually, you can use that money, your money, to help pay for your kids future and college expenses. E.g. You get rich, and then use your money to help them pay for life! This account isn’t a kids account, it’s just your account that you can use to make money for your kids.

One of the benefits of a regular brokerage account is that you can withdraw the money at any time for any reason, while most of the tax-advantaged accounts on this list have rules and stipulations on when you can withdraw money and for what reason, otherwise you may lose the tax benefits and pay fees. This account is much more flexible and may even have better returns over time (usually it does).

You can even open a brokerage account and transfer it to them when they become old enough under the UGMA or UTMA.

Once you’ve opened a taxable brokerage account, you have to choose some investments.

Choose your investments

Here are some of the most common types of securities you can invest for your kids’ future through a brokerage account:

- Stocks a.k.a. shares

- Index funds (my personal favorite!)

- Mutual funds

- ETFs (Exchange Traded Funds)

- Bonds

You can choose to invest in shares for your kids’ financial future if you are saving for them over the long term through a custodial traditional or Roth IRA account or a brokerage account. Make sure to buy shares of several reputable companies to diversify your portfolio, or choose index funds/mutual funds (already diversified for you!).

Mutual funds pool money from many different investors and then invest the funds in many different types of securities such as stocks, bonds, and other investments. The price of a mutual fund changes based on the value of each security it holds at the end of each trading day.

You can invest in mutual funds through traditional or Roth IRAs, 529 plans, and other plans to reap long-term rewards for your kids’ future. You can buy or sell shares of a mutual fund any day the stock exchange market is open, but your order is executed after the market closes each trading day.

ETFs are like mutual funds but they are traded throughout the day of trading hours on the stock market exchanges. An ETF holds many different types of securities, so it is already diversified and reduces your risk.

You can also invest in primary bonds or secondary bonds (e.g. through an ETF that exclusively invests in bonds), depending on your investment account(s), and investing goals for your kids.

Open a regular taxable brokerage account here

Know the risks

When it comes to investing for your kids’ future, make sure that you understand risks that come with investing for your child. The value of your investments can change (fall or rise) from time to time.

Depending on your investments, your kids could get back less than you invest, so make sure you research your investment options carefully and understand the risks before you start investing for your kids’ future.

Also, it is worth noting that some of the investment options will not let your child access the money until they reach a certain age.

In general, you are more likely to gain from your investments over the long term if you pick the right investment strategy for your kids.

How much do you want to invest?

It will depend on your current circumstances. If you have set aside some money already, then you can start investing for your kids’ future with that amount.

If you are ready to start investing for your kids’ future, but do not have enough money to open an investment account, start saving now. Work out how much you can set aside per week or month toward the choice of your investment account for your kid.

Save as much money as possible. You can then use that money to invest in stocks, bonds, mutual funds or any other investment instrument. If you start saving now, your money will build over time and you can then take the money from your savings account to invest in different places.

In conclusion

As you can see, there are various ways to start investing for your kids’ future. You can contribute to a plan to save for your kids’ college expenses and/or invest in a retirement savings plan to save for your kids’ retirement.

Sit down with your kids when they are old enough and share your investing ideas for their future. Make sure to teach them the value of hard work and responsibility to help them reach their investing goals!

Do you have any questions about investing for your kids future? Let me know in the comments below.

Did you enjoy this post about investing for your kids’ future? If so, pin it to Pinterest for later!