This post may contain affiliate links where I earn a commission, at no additional cost to you, if you decide to make a purchase after clicking on a link. Please see our Disclosure Policy for full details. Thank you for your support!

When I say the zero-based budgeting method changed my life, I mean it.

3 years ago, I sat down to make my first ever real budget. I had tried some other “budget-like” methods before (looking at my spending after the month was over, using an envelope to write all my purchases down, etc.) But nothing was really sticking. Nothing was helping me feel like I actually had a grip on our money.

That is, until I learned about zero-based budgeting.

It changed my life. And it will change yours too.

Today, I’m going to tell you what zero-based budgeting is and how this method was the single most important factor in helping my family of 5 pay off all $71,000 of our debt in just 2.5 years on a single income.

To read more about our debt payoff journey, read my article How We Paid Off $71k of Debt in Less Than 3 Years on a Single Income.

You need this method in your life right now. Let’s dig in and discover how zero-based budgeting can change your life and catapult you into debt freedom and beyond too.

What is Zero-based Budgeting?

A zero-based budget means that you make a plan for every single dollar that you earn, down to the penny, before the month starts. Zero dollars will be left unbudgeted (hence the name, zero-based budget)! Typically, you might plan out all your expenses and then have some money leftover. Don’t leave that money unbudgeted. Plan for it to go to savings or toward your debt, and then you’ll have a zero-based budget. All incoming money is considered income, and all outgoing money is considered an expense (even extra debt payments or savings).

Income – Expenses = Zero

It’s so simple, and yet so profound. As Dave Ramsey says, give every dollar a name and tell it what to do or it will fly out the door and get wasted! That resonated with me so much when I first heard it. We were just sort of spending and earning without looking at it and really planning the money out.

How to Create Your First Zero-based Budget

To create your first zero-based budget, do exactly what I did!

I sat down with a pen and paper and printed out all our bank statements. Then, I looked over the last 3 months worth of statements to see how we were spending our money.

Using those statements, I created some budget categories and determined how much we were currently spending in each of them. Next, I determined which categories we were overspending in and cut those back by about 10% each.

Here are some of the budget categories I use in our budget, which hasn’t changed much in 3 years!

FIXED:

Rent/Mortgage

Auto Insurance

Health Insurance

Life Insurance

Other Insurance

Subscriptions

Mobile Phone Bill

Utilities

Electricity

Internet

VARIABLE:

Groceries

Restaurants

Gas

Personal Allowance

Date Night

Clothing

Entertainment

Household

Haircuts/Grooming

Gifts

MISCELLANEOUS:

Mom’s Birthday Gift

Johnny’s School Supplies

Tree Trimming

New Office Chair

For miscellaneous, write in a category for any expense unique to the month you are currently budgeting for that doesn’t tend to repeat.

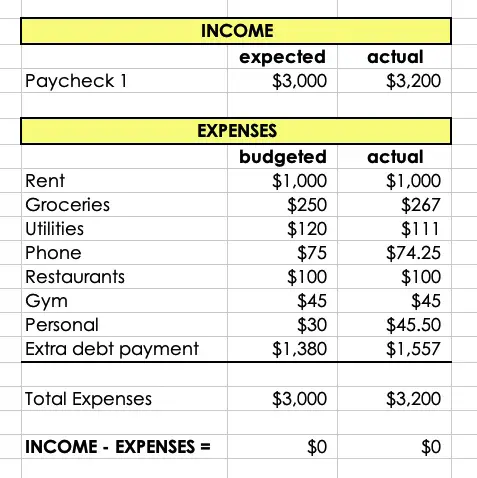

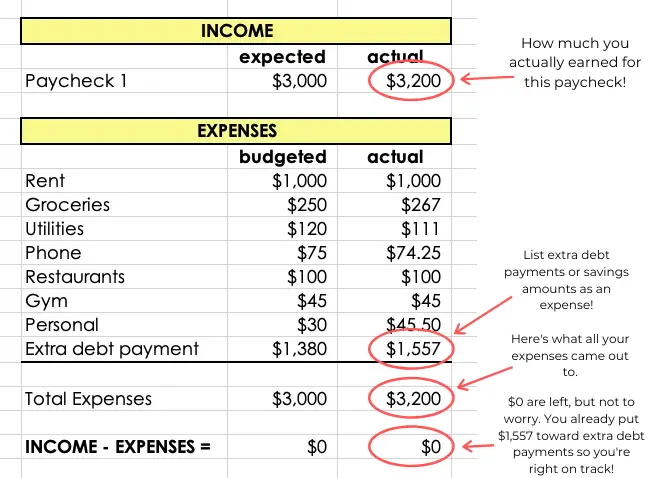

Each time we got paid (yes, you need to budget out every paycheck you earn separately) I wrote down our income. I wrote out all our expenses for that pay period. Then I did a simple calculation to figure out how much we could send to debt that pay period:

Income – Expenses = _________

e.g. $3,200 income – $1,643 expenses = $1,557 remaining

Since we were working on paying off our debt at the time, whatever was left remaining is how much we would use as extra debt payments to turbo-charge our debt payoff journey. I would add that amount to my budget as one of our expenses to make the equation equal $0. Every dollar budgeted out.

Income – Expenses = $0

e.g. $3,200 income – $3,200 expenses (all bills, spending, and the $1,557 extra toward debt) = $0.

Sample Zero-based Budget

Now, let’s break this down even further!

Every dollar was planned out! I would do this for every single paycheck we got. The expenses would be the things we were actually paying for with each paycheck. We paid for certain bills with our first paycheck of the month, and other bills with the second paycheck just depending on the due date of each bill. I would set aside some money for larger bills, like the mortgage, from each paycheck.

IMPORTANT: A common misconception about zero-based budgeting is that your bank account is sitting at zero. This is not the case! Either keep a buffer in your bank account (i.e. $100) or simply make your extra payment to debt on the last day of the pay period when you’re about to get paid again.

Where Should You Keep Your Budget?

Check out my FREE budgeting spreadsheet. Downloaded over 7,000 times, it’s a fan favorite. And yes, I use it too! I recorded a video tutorial to go with it to help you learn how to work it and how to fill it out with your zero-based budget from start to finish.

HELPFUL TIP: You can pay extra money toward debt immediately after getting paid if you don’t trust yourself not to spend it, or if you need more flexibility do it when the pay period is over and you’re about to get a fresh paycheck. We did it both ways just depending on the month, but usually at the end of the pay period. This gave us flexibility us case something “came up” that we needed to pay for and hadn’t budgeted for.

Throughout the month I follow the plan I made for every dollar, only spend what I planned to spend, and do my best to not go over budget.

I still budget this exact same way every month, only now my extra money goes toward savings since we are debt-free!

How the Zero-based Budgeting Method Catapulted us into Debt Freedom

I am a spender. So is my husband! If there is money available, especially unclaimed money, we are going to spend it. Zero-based budgeting was revolutionary for me because we no longer had unclaimed/unplanned money EVER. So there never was money sitting around in our bank account that was free to spend. I knew every dollar had a name and a plan, and if I spent it, it wouldn’t be able to be used for its intended purpose and it would throw off our debt payoff plan!

It worked!

We were able to pay off over $2,200 of debt every month until we were debt-free!

We were never perfect, of course, but this changed the game. I was budgeting every paycheck out, tracking all our spending, and sending all unused money at the end of the pay period toward our debt. And over the course of 2.5 years, we paid off $71,00 of debt!

I hope you’ve found this zero-based budgeting information inspiring and informative! I am still using this exact same budgeting method today to help us save up for a new vehicle, save our emergency fund, and work toward our other financial goals.

Ready to get started on your own zero-based budget? Get started with my FREE digital budgeting spreadsheet.

Before you go, save this to Pinterest!