This post may contain affiliate links where I earn a commission, at no additional cost to you, if you decide to make a purchase after clicking on a link. Please see our Disclosure Policy for full details. Thank you for your support!

Over the last four years my husband and I have been focused on growing our net worth. We’ve been investing in real estate, his company 401k plan, and saving up an Emergency Fund. We save and invest over 40% of our income, so as you can imagine, our net worth has been growing! The problem was, we really needed a good and accurate way to keep track of our rapidly growing net worth and we didn’t have one.

About two years ago my friend recommended the Personal Capital app for tracking net worth.

Related reading: How We Paid Off $71k of Debt in Less Than 3 Years on a Single Income

I decided to give it a try. And man was I blown away!

Today I’m going to show you how we track our rapidly growing net worth (gone from -$70k to over $350k+ in 4 years) with the Personal Capital app and how you can do it too.

I’ll also show you some of the most essential features of it that I love and why I keep coming back to it again and again instead of calculating our net worth by hand or with a spreadsheet.

How We Track Our Net Worth (And How You Can Too)

1. Create an Account on Personal Capital

The first step is to download the Personal Capital app or go to the website and create an account. It’s free! They have some paid products too, but the net worth tracker is free, which I love.

2. Connect all your financial accounts to the app and it will autofill your assets and liabilities

The next step is to connect all your financial accounts to Personal Capital so it can track as they grow or shrink! Personal Capital can connect to nearly any financial institution and pull your numbers from it. As far as I know, their system is very secure.

You can connect your liabilities like your:

- Student loan debt

- Car loan accounts

- Mortgage

- etc.

Then you can connect all your asset accounts like your:

- IRA

- 401k

- Regular brokerage account

- Savings account

- etc.

Personal Capital will then automatically calculate your net worth based on all these accounts by taking:

Assets-liabilities = net worth

Related reading: How to Calculate Your Net Worth + Why You Need to

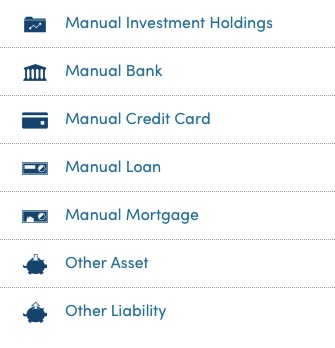

3. Manually enter any assets or liabilities that you can’t connect to

If you have any assets or liabilities that you can’t easily connect through a financial account (or maybe you don’t want to connect them for some reason), don’t worry!

You can add them in manually with just a few clicks.

This has really come in handy for us because we own several apartment complexes with a group of other investors and our percentage of the ownership can’t be found in a bank account. So we add these ones in manually. They do have to be updated every few months manually as well, but it’s not a big deal because the rest of our assets update automatically.

To do this: While on the website or the app, find the button that says “link another account,” then hit “more,” and then scroll until you see “other asset,” “other liability,” or one of their other manual options and it will allow you to add one in manually.

4. Check in with your net worth monthly and watch it grow

There’s no real need to stalk your net worth every day. It’s just something that you want to check in with from time-to-time! Monthly is great.

The Features of the Personal Capital App I Love the Most:

💙Automatically updating accounts

Since your financial accounts are connected to Personal Capital, as your 401k, IRA, and investment accounts grow, the app will reflect that automatically! Conversely, if you take on new debt it will also show that as a liability. Make sure you add in new accounts when you open them.

💙Ability to add in assets/liabilities manually

This was essential for us because not all of our assets are straightforward. This feature if perfect if you are like us and have some assets that aren’t straightforward and can’t be connected through a simple bank account, or you don’t want to connect your accounts for some reason. This will allow you to make sure your net worth is correct on the app.

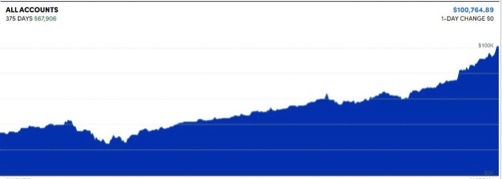

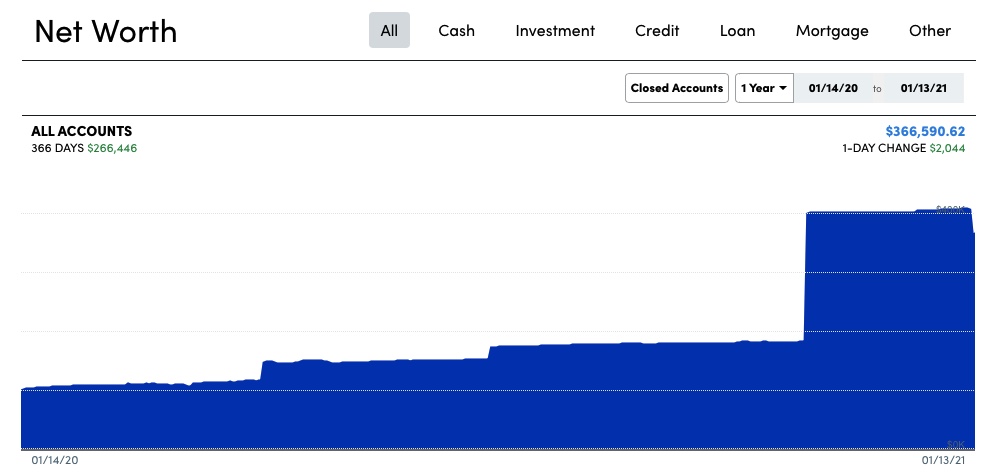

💙Graphs

The graphs are the best! The main graph shows as your net worth grows and grows and it’s really motivating. I’m part of the ChooseFI Facebook group where members regularly share their net worth milestones ($100k, $1m, etc.), and almost all of them share their graphs from Personal Capital because it illustrates the growth so visually!

Some Net Worth Milestones to Look Forward to:

•Going from negative net worth to positive

•Your first $100k

•$500k

•$1 million

It’s never too soon to start tracking your net worth. So even if you are in debt right now, start tracking it! That moment when you go from negative to positive is so awesome.

Also, a huge goal for a lot of people is to reach your first $100k. “They” say the first $100k is the hardest, and that after you achieve that your net worth starts to grow exponentially and fast! So if you need a goal to work toward, make that your goal and get to work!

I’ve really enjoyed using Personal Capital to keep track of our net worth over the last 2 years. It’s the most automated, accurate, and fun net worth tracker I have found.

I hope you enjoyed this post! Are you going to start tracking your net worth?

Did you enjoy this post? Pin it to Pinterest for later!