This post may contain affiliate links where I earn a commission, at no additional cost to you, if you decide to make a purchase after clicking on a link. Please see our Disclosure Policy for full details. Thank you for your support!

Ready to make the big switch from credit to debit? It can feel like an overwhelming and impossible task, but let me tell you from personal experience, it will change your life! The average credit card interest rate is 16%, which keeps most borrowers barely able to make the minimum payments and unable to pay it down fast enough before that interest piles back up. Making the switch from credit to debit is one of the best moves we ever made. You won’t regret taking the time to do it yourself!

What are the benefits of switching from credit to debit? There are so many!

Your finances will be simpler to manage. You won’t be tempted to spend more than you make. Budgeting will be faster and easier. Living within your means will be more realistic. You’ll have to think twice before making a purchase.

The only cons? You have to make sure you spend less than you make, and you won’t earn credit card rewards points.

In most cases, the benefits of giving credit cards the boot far outweigh the cons.

Let’s break down how to make the switch easy and painless.

Related reading: How We Paid Off $71k of Debt in Less Than 3 Years on a Single Income

How to Switch From Credit to Debit in One Day

1. Make sure you have a budget in place

This will ensure you can live within your means and give you the boundaries to stay within. If you’re no longer choosing to swipe your card, you need to know the spending limit you can’t surpass. This is where a budget comes in! A budget is the roadmap to ensure you can meet all your family’s needs without swiping a credit card. Without it, you may turn back to your credit card when you weren’t careful enough and don’t have enough cash.

Pro tip: After your budget is in place, try every month to pay for your needs before wants! Pay bills, groceries, gas, and other essentials right after you get paid and wait to buy any “wants and wishes” toward the end of the pay period, if you have money leftover. If you do it the other way around, this is what happens: You feel so rich after you paycheck hits your bank account, you buy your wants and wishes early on, and then eventually you need to get groceries and gas and you can’t let your family starve, so you have no choice but to swipe your credit card. Switch these around! Needs first, wants later (if you have the money).

2. Cut up the credit cards

Yep, seriously! Grab a big pair of scissors and give them the big snip snip!! Make it a momentous occasion! Don’t cut corners by freezing them in a block of ice like some people do. Ice is too easy to unfreeze. Remove the temptation to use the cards. You can leave the accounts open, but make it impossible (or really hard) to use the cards.

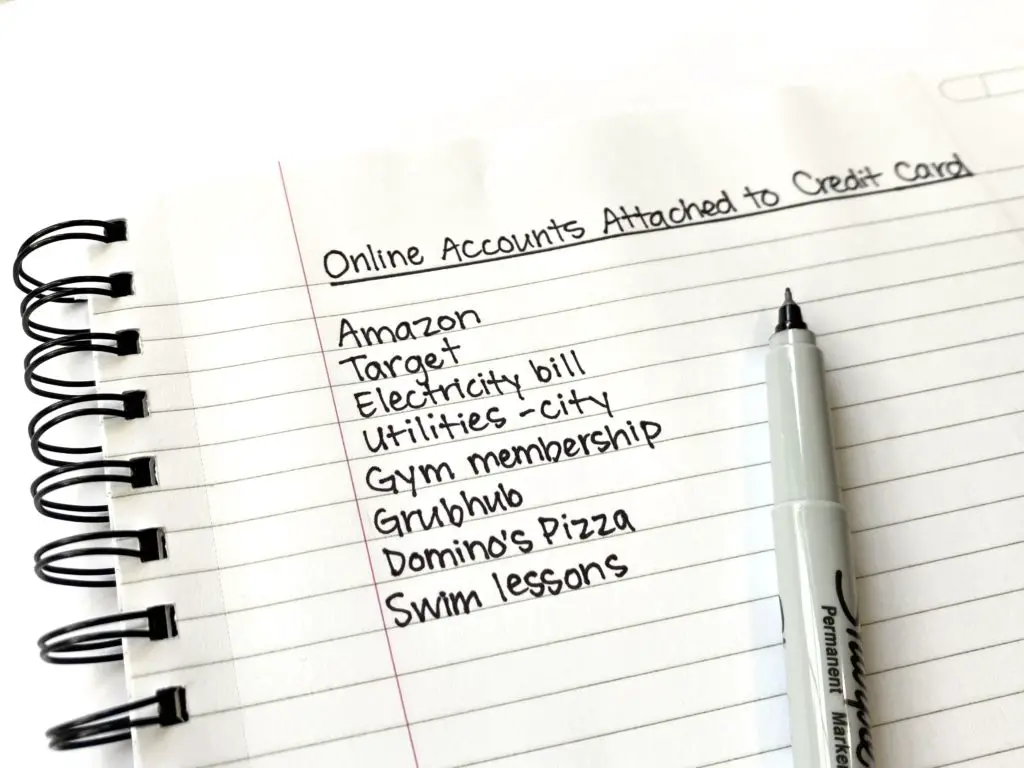

3. Make a list of every online account connected to your credit card

This step is simple. Login to your credit card account and go through all the transactions from 1-2 statements. Jot down all the online stores and accounts that are connected to your credit card on a piece of paper.

4. Go through each account and change it from your credit card number to your debit card number

Go through the list one by one, switching the online accounts from your credit card number to your debit card number. Once all the names are crossed off, you’re done!

Now you have a budget in place to ensure you won’t need to rely on your credit card, you’ve cut up your credit cards so you can’t physically swipe them, and you’ve switched all online accounts over from credit to debit.

You’re all set!

The next step is committing to using cash (or debit) and forgetting credit cards are even an option. When you’re committed to this, it will be easy not to swipe. You’ve already put a structure in place so that you don’t need to swipe, so now your inner commitment needs to match!

Credit cards can keep you drowning in interest and most people don’t benefit from the points or rewards they offer, so just forget about those and stick to your plan!

Did you enjoy this post? Pin it to Pinterest for later!