This post may contain affiliate links where I earn a commission, at no additional cost to you, if you decide to make a purchase after clicking on a link. Please see our Disclosure Policy for full details. Thank you for your support!

Part of getting super clear about your finances is understanding your net worth. But don’t stress out if you don’t even know where to begin! Today, I’m going to help you better understand what net worth is, why it’s important to know, exactly how it’s calculated, and how you can calculate your own net worth the fun way! By the end of this article, you’ll be a net worth pro.

What is net worth?

Your net worth is the value of all your assets (things you own) minus your liabilities (things you owe, or ya know, debt). Your net worth can be positive or negative! Net worth is like a snapshot of your current financial status. It’s a very important thing to measure when evaluating your financial situation. Everyone should know their current net worth status! Whenever you hear people discussing super wealthy individuals, like Warren Buffet or Jeff Bezos and saying that are worth $90 billion, they are referring to their net worth.

How is net worth calculated?

Net worth is calculated by adding up all of one’s assets and then subtracting all of one’s liabilities. It’s a really simple math problem!

Assets may include:

- Cash

- 401ks

- IRAs

- Investments

- Rental properties

- Vehicle market value

- Valuable jewelry or possessions

- Current market value of home*

Liabilities may include:

- Student loan debt

- Credit card debt

- Vehicle loan balance

- Other debts

- Mortgage balance*

*Some people get confused about how to include their home on their net worth. All you do is include your home’s current market value as an asset, and the amount remaining on your mortgage loan as the liability. The difference between the two is called your home equity and that is the amount that will go toward your net worth! For example, if your home’s current value is $240,000, and you still owe $210,000 on your mortgage. You list $240,000 in home assets and $210,000 in mortgage liabilities. When you take all your assets and subtract all your liabilities to get your net worth, $240,000-$210,000 = $30,000 in positive home equity will be added to your net worth from your home! Hopefully it’s positive equity, but not always.

It’s very similar with vehicles. If you’re upside down on your vehicle, you might put $20,000 in as your car’s current value as an asset, but $25,000 in as your vehicle loan balance under liabilities. The difference is -$5,000, so $5,000 will be subtracted from your overall net worth.

Why is it important to know?

Net worth gives a clear picture of how much you own and how much you owe. Most people have a certain net worth goal they need to achieve before they can retire. You need to keep track of that number regularly so you can ensure you are on track to retire when you plan. Your net worth can also help motivate you to make better financial decisions! If you are paying off debt or recently became debt-free, you’ll need a new number to get excited about! Net worth growth is so fun to watch.

What’s the best way to calculate my own net worth and keep track of it over time?

I have tried calculating net worth by hand, with a spreadsheet, and through apps. They all work great! The one you choose will just depend on your preferences.

The best net worth spreadsheet

A spreadsheet is a great way to keep track of your net worth, and I have one you can download for free! Get it below. Keep in mind this won’t update automatically, you’ll need to go in from time to time and update all the numbers manually. It’s not that hard to do though and you don’t need to be obsessively checking your net worth all the time, anyway!

The best net worth app

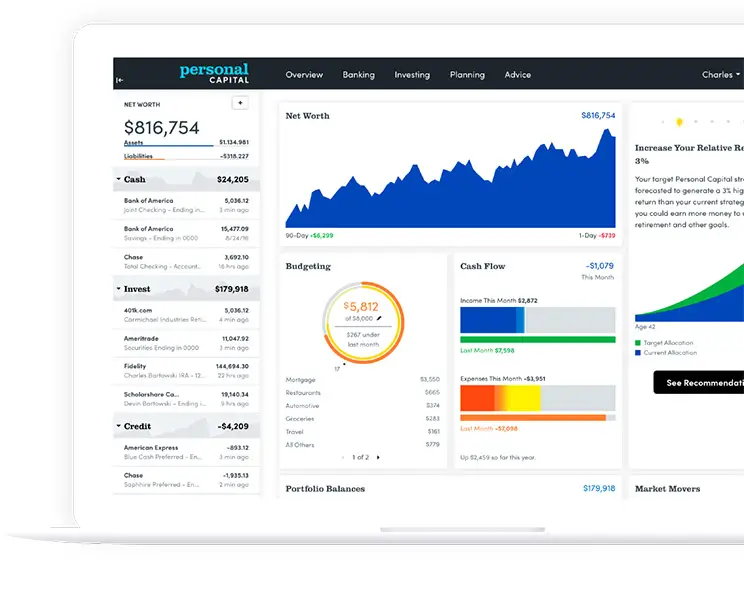

About a year ago a friend introduced me to the Personal Capital app (it’s free!) for tracking net worth. I made the switch and I’ve never looked back. They have done an excellent job at making it user friendly, simple, and very functional. It actually connects to all your financial institutions (banks, IRAs, even 401ks, house loans- everything) and plugs the real-time numbers in. It automatically takes all your assets and subtracts your liabilities and shows your net worth!

When I started using the app, it took me about 10 minutes to set it up and add in all of my accounts. I created a profile and then it prompted me to enter in all my assets and liabilities. I just followed the prompts!

For my assets I entered my bank institution, my husband’s 401k servicer, my private IRA account through Vanguard, and I was even able to enter my house value in (they use Zillow, so I just plugged in my address and my house’s Zestimate filled in automatically as an asset). You can also manually add in assets and liabilities. We own some real estate but we are involved with partners and anything the banks or mortgage would show wouldn’t be reflective of our actual equity in the properties, so I just added those in manually.

Then I added in all our liabilities, which right now is just our mortgage, which we have through Quicken. So I was able to link Quicken to it and it automatically pulled up the remaining balance on our mortgage as a liability.

In just seconds I had all my assets and liabilities (in their exact amount direct from the financial institutions) plugged in, and my net worth was calculated!

I was thrilled to see that ours was actually higher than I thought! In fact, when I first entered all our info into Personal Capital, we were at $99,000 net worth! They say the first $100,000 is the hardest, and after that there is crazy growth. Watching it go from $99,000 to $100k and now beyond that the last few months has been so motivating and so exciting! I love watching our numbers grow.

Start tracking your net worth on Personal Capital by clicking here.

Calculating with pen + paper

You can also calculate your net worth occasionally by just good old fashioned pen and paper! Write down all your assets and liabilities, then do Assets – Liabilities = Net Worth! One of the benefits of using a spreadsheet or pen and paper and not an app is you won’t be able to obsessively check your net worth! You really don’t need to be checking it all the time, just check in with it monthly and that’s plenty, or even less if you’re further along in your financial journey. Sometimes the app makes you want to check in on it daily and that’s definitely overkill.

I hope this has helped you better understand net worth, how it’s calculated, and given you all the tools you need to calculate your own net worth! Understanding and being aware of your own number is a huge part of your finances and if you don’t know your net worth, you need to get calculating right now!

Do you have any questions about net worth that I didn’t answer?

Are you on Pinterest? Save this article for later!