This post may contain affiliate links where I earn a commission, at no additional cost to you, if you decide to make a purchase after clicking on a link. Please see our Disclosure Policy for full details. Thank you for your support!

How would it feel to be completely debt-free and not owe a dime to anyone? Wouldn’t that be amazing? Well, it is! And today I’m going to help you figure out how soon you can have your debt paid off by giving you two easy ways to calculate your own unique, custom debt-free date!

Before you dive into all the hard work of paying off debt, it’s nice to have an idea of how long it will take you to become debt-free. But interest compounding against you and a varying budget to put toward debt every month can make it a bit complicated.

Today, I’m going to give you two different ways to determine how soon you can be debt-free based on your completely unique income, expenses, and how much you can typically afford to put toward your debt each month, even if you have varying income.

If you haven’t added up all of your loans yet, start by adding up your debts with our free Add Up Your Debt Worksheet.

Related reading: 7 Steps to Paying Off Big Debt

Method 1 – Calculate Your Debt-Free Date by Hand

You can do a simple calculation by hand to determine how soon you can have all your debt paid off. It may not be exact to the month because it doesn’t account for your interest going down over time as your total debt goes down, but it will give you a good range of how many months it will take you to be finished!

For this example, we are assuming you will pay the same amount toward your debt every month until the debt is paid off (i.e. $1300 a month toward debt from now until it’s all paid off. This includes minimum payment and extra payment, even though over time your minimum payments will go down as you pay debts off, you’ll take that money and keep putting it toward debt.)

Grab a piece of paper and a calculator. Here’s the math problem you’ll need to do:

Total Debt x (Average Interest Rate expressed as a decimal + 1) ÷ Amount of $ You Can Pay Toward Debt Each Month Including Minimum Payments

Here’s an example of how that would look:

$50,000 total debt x (.15 + 1, my average interest rate being 15%) ÷ $1300 I can put toward debt every month, including my minimums, until I’m debt-free.

$50,000 x 1.15 ÷ $1300 = 44 months

So in this example it will take around 44 months to pay off all $50,000 of debt with about a 15% average interest rate if we put $1300/mo toward the debt until it’s paid off.

This estimate may be a little high because over the course of paying off your debt, your interest will actually go down, but there isn’t any easy way to account for that by hand.

If you want something more precise, there is a second way you can determine how soon you can be debt-free that is much more customizable.

Method 2- Calculate Your Debt-Free Date with a Debt Snowball Calculator

If you want a shortcut that’s even more accurate, I have one for you!

In 2016 we created a tool that would help us determine how soon we could be debt-free even though our income and expenses were all over the place, and as a result, the amount we could pay toward debt differed every month.

Now, we’ve made that same tool we used available to everyone.

Easy Budget Debt Snowball Calculator

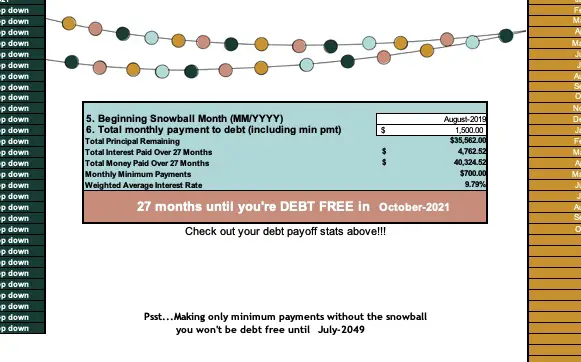

This is a smart spreadsheet that can do all the hard interest math for you!

Simply enter in all your debt balances, interest rates, and minimum payments, how much you can pay toward debt every month, the start-date, and any future extra payments toward your debt (if you have variable income or lump-sums you’d like to account for), and your debt-free month will calculate automatically.

It’s completely customized to your unique income, expenses, varying income, interest rates, and plan to pay off your debt.

You can also quickly switch between the debt snowball and debt avalanche methods of debt paydown, or enter your loans in a completely custom payoff order.

You will need either Google Sheets or Microsoft Excel to run this spreadsheet, but once you have all your loans entered you can have your debt-free date calculated accurately and down-to-the-month within 2-3 minutes!

I highly recommend Method 2, not just because it’s something I created, but because your situation is constantly changing and you may need to re-calculate from time-to-time. With this tool, you can do that in just seconds, and it’s much more accurate.

Plus, you can easily play around with different payoff scenarios, i.e. if we put an extra $200 per month toward debt, how much sooner can we be debt-free? And it’s the most motivating thing ever!

Grab your own Debt Snowball Calculator here.

When it comes to finances, paying off your debt is one of the very best first steps you can take. You’ll never regret the boost it gives you on your journey to wealth and prosperity!

I hope you’ve found both of these methods to calculate your debt-free date helpful and simple!

Are you thinking about paying off your debt?

Did you enjoy this post? Save it to Pinterest for later!