This post may contain affiliate links where I earn a commission, at no additional cost to you, if you decide to make a purchase after clicking on a link. Please see our Disclosure Policy for full details. Thank you for your support!

Today I am going to tell you how the cash envelope method can transform your financial future, keep you out of debt, and help you pump up your savings!

All you need to get started is a plan and some cash envelopes! I’m going to cover both of those today.

Have you ever experienced a time where there was more month than money? You know, when payday is still a few days or weeks away but the money is gone and you’re scratching your head wondering where it all went? Or worse, it’s racking up on a credit card and you don’t know how you’re going to pay it off.

We have! When I was still figuring out budgeting back in 2017, money was flying out the window. It felt like we were trying but the money was always gone when payday was still a few days away, leaving us stressed and frustrated. When I finally figured out zero-based budgeting, I was able to gain control over this broke paycheck-to-paycheck cycle and start really putting my money toward important goals. But even as a pro budgeter, it’s still hard to keep money from flying out of the bank account, especially when it only takes one click or one swipe to spend money these days.

It’s hard to feel in control. It’s hard to not overspend.

In 2019 we decided to try using the cash envelope method for some of the areas in our budget where we were grossly overspending. The cash envelope system is an incredible solution to regular overspending that has helped thousands of people control their spending, pay off debt, and save more money.

Let me tell you about how the cash envelope has worked for us and how it can change your life.

What the Cash Envelope Method is

With the cash envelope method you create a budget and then instead of using your credit or debit card to swipe and spend, you withdraw the amount you budgeted for in each category in cash and place it in cash envelopes. Typically you won’t use cash for every single item in your budget, only discretionary spending items (think groceries, restaurants, beauty, etc.) You pay for these types of purchases with cash from the envelopes instead of on cards, and when the money is gone, you stop spending. Period.

To easily figure out which categories you should switch to cash envelopes and which categories you can keep paying for online or with a card, ask yourself “am I at risk for overspending in this category?” If the answer is yes, you should switch that budget category over to cash. Paying your water bill with cash wouldn’t help much, because you aren’t really at risk for overspending on your water bill. Switching your restaurant spending over to cash, however, would make a huge impact because you have direct control over your restaurant spending and are at risk for overspending.

How the Cash Envelope Method can Help You Control Your Spending

Studies have shown that most people spend less when they use cash. The physical act of putting the dollars in someone’s hand and seeing them go is more painful than swiping a card, and the physical ability to see when the cash is gone and you have no money to spend will prevent you from overspending. Swiping plastic can be so easy and can lead to massive overspending! Cash envelopes force you to think twice before spending.

If you run out of money in your cash envelope, you cannot spend any more money. This method won’t work if you just pull out your card when the cash in your envelope is gone. You must practice discipline so that if the cash is gone, you do not spend.

How to Get Started with the Cash Envelope Method

- Create a budget. Finding the best system can be frustrating. Check out my digital budgeting system to see how it can help you get your budget right. I recommend you budget out each paycheck for the month instead of a solid month long budget.

- Figure out which categories you will use cash envelopes for. You do not need to use cash for every single expenditure with this method. Continue paying your bills online or with your debit card because you’e not really at risk for overspending in those areas. Plan to use cash in areas you have direct control over and are at risk for overspending in. I recommend using cash for discretionary spending such as:

- Restaurants

- Beauty

- Groceries

- Household basics

- Shopping

- Personal allowance

- Date night

- Gas

- Entertainment

- Print out or make cash envelopes, and label one for each of your categories

- Every time you get paid, pull out cash to fill your cash envelopes

- Use the cash envelopes to pay for your discretionary purchases. When the cash in your envelope is gone, do not spend any more. It is not recommended to borrow from other envelopes, but if you must, do so sparingly.

Monthly Cash Envelopes Example

Let’s say you get paid twice a month.

The first paycheck of the month comes on January 31st but it will be used for the first half of February’s spending and bills, so it’s the first paycheck on your February budget. The amount is $2000. You decide to budget $400 for your cash envelopes divided up like this:

- Groceries – $200

- Restaurants – $50

- Beauty – $100

- Fun Money – $50

You go to the bank on payday and get $400 cash out. You then divide it up and stuff your cash envelopes with the cash, and you’re ready to go! This cash needs to last you until February 15th when you get your second paycheck of the month. You will continue paying your rent, bills, subscriptions, etc. online.

On February 9th, you hit up the drive through of McDonald’s and check your cash envelope. There is only $5 left. You can’t order a full size meal so you must order only a drink and a cheeseburger and be on your way. On the 10th, you go to purchase groceries. The total comes out to $110.81, but you only have $102 left in your groceries envelope. Yep, you guessed it, you must put something back. You ask the teller to remove a couple items and put them back to bring your total down to $101.20 and check out.

Now February 15th has rolled around and you get paid again, and the amount is $2000. Hallelujah. Time to go back to the bank and get more cash out. You get another $400 and divide it up amongst your envelopes the same way:

- Groceries – $200

- Restaurants – $50

- Beauty – $100

- Fun Money – $50

This cash must last you until your next paycheck comes on February 28th. You will continue paying your bills for this pay period online.

For this method to work, it is very important that you practice discipline and stop spending when the money in your envelopes is gone! Otherwise, it won’t do anything for you and you’ll have wasted your time.

Before you determine if this method would work for you, it can be helpful to evaluate the pros and cons, because there are many! Let’s dive into those.

Pros of Cash Envelopes

- Fewer transactions to reconcile when you balance your budget (e.g. one cash withdrawal instead of 20 little fast food purchases)

- Easily see you have no more money to spend

- Forces you to be organized

- Deters impulsive overspending from online and card purchases

- Total awareness of your budget and spending

Cons of Cash Envelopes

- You can lose cash

- Can be impractical if you do a lot of online shopping

- Requires organization to get cash out in a timely manner

- Requires you to go to bank and withdraw cash every time you get paid

We decided that instead of being all cash or all card spenders, we were going to make it work for us and take a hybrid approach. We still primarily use our cards (I don’t want to have to go inside a gas station to pay cash when I have 3 kids in the car, I even do my grocery shopping online with Walmart Grocery Pickup), but there were a few areas we were overspending that we could definitely use cash for.

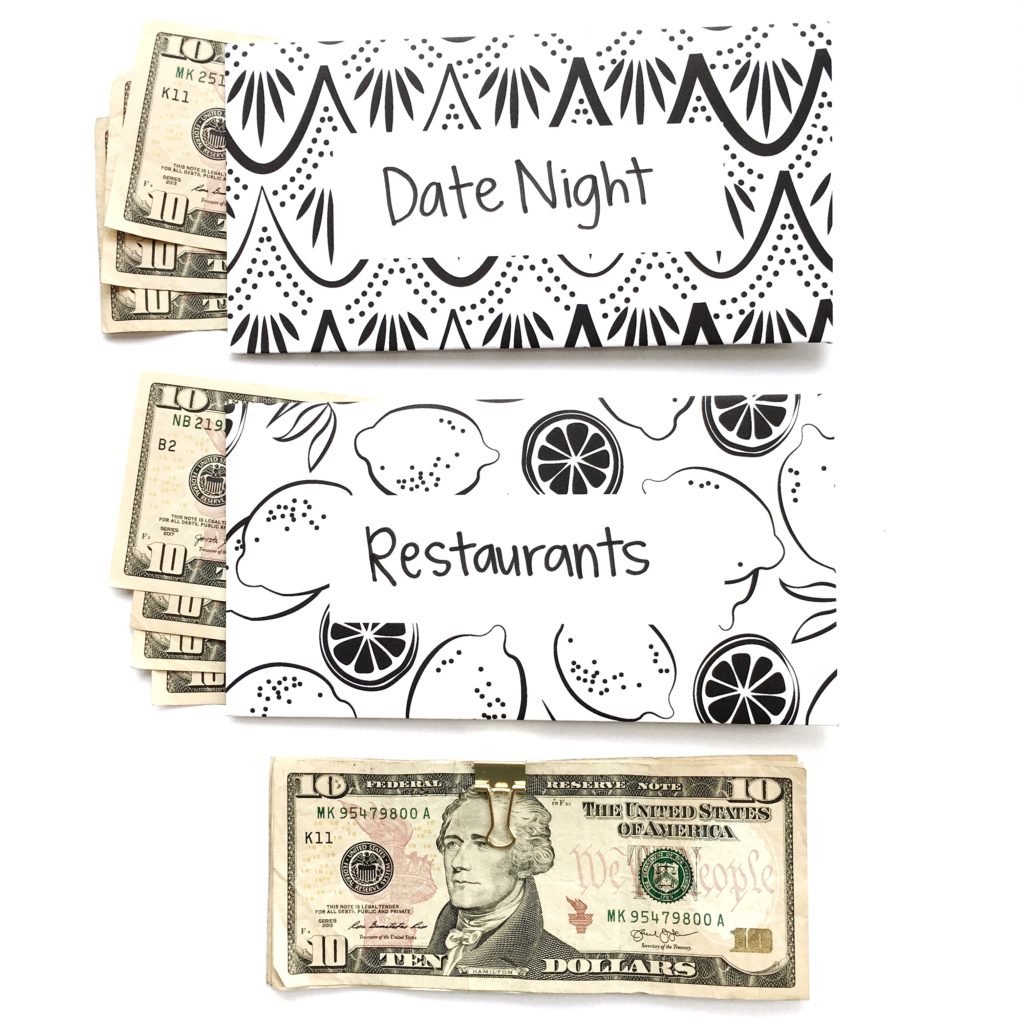

We decided to start small and use cash for our date nights and restaurant spending. Both work because they never need to be done online, and we tend to overspend in those areas.

I love using a partial cash system! If you are interested in trying the cash envelope method, I do want to encourage you to use cash wherever you can. If your spending is really out of control and you need a 100% cash envelope method for all your non-bill spending, I would do it. If you need a little more flexibility like me to make it work for your busy life, do that.

I love not having as many transactions to balance in my budget and I definitely spend less. Where normally I would think to myself “I’m sure theres enough money left” and drive through the Chick-Fil-A drive-thru, I look in my envelope and if there is no money left, I don’t go out. It’s that simple.

This method has helped thousands of people get control of their spending and it can help you too!

Are you ready to try the cash envelope method?

Printable Cash Envelopes

If you are, you’re going to need some cute cash envelopes! I have two different sets you can snag and print off to get going with your cash envelopes today.

The black and white set is beautifully designed for those of you who like a classic look and also those of you who don’t have any color ink in your printer (I got you!)

The color set is bright and fun and will make you smile when you reach for them in your wallet.

You can also get crafty and make your own envelopes for FREE! Just grab some colored paper, take apart an old envelope you have and trace it, then glue it and voila!

Keeping Your Cash Envelopes Organized

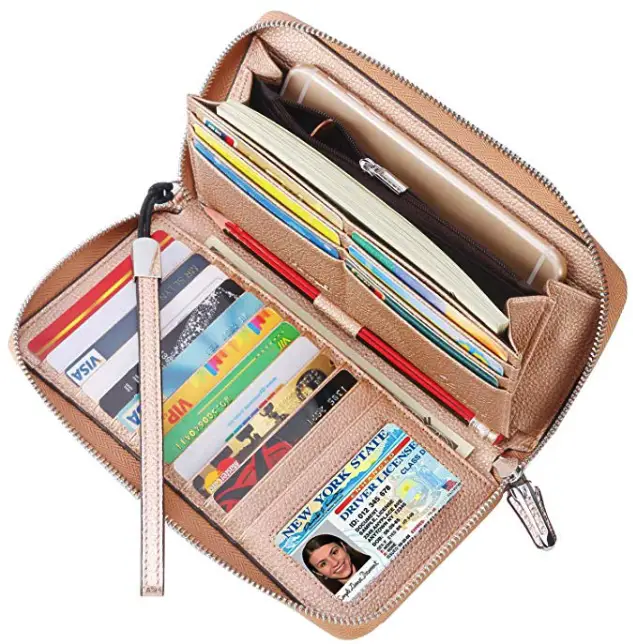

To organize my cash envelopes, I use this wallet which holds my cash envelopes perfectly and has tons of room for change, cards, receipts, and even a pen. It’s great quality and should hold up for a long time. I recommend it if you are beginning the cash envelope method and need a wallet that can accommodate envelopes. It’s real leather, comes in tons of colors, and is less than $30.

I really hope you are considering the cash envelope method if you are struggling with your spending. Gaining control of your spending is what will help you pay off debt or save more money, and this method is one of the best ways to take that control back!

Common Questions and Answers

What do you do if there is cash left over in an envelope at the end of the pay period?

You can either roll it over into your next pay period (yay, extra cash for you to spend!) or put it toward your main goal (debt payoff or savings). It really depends the amount. If you have just a few dollars left, it might be easiest to just roll it over to the next pay period. If it’s a lot, like $20-100+, then it’s probably best to put it toward your main goal.

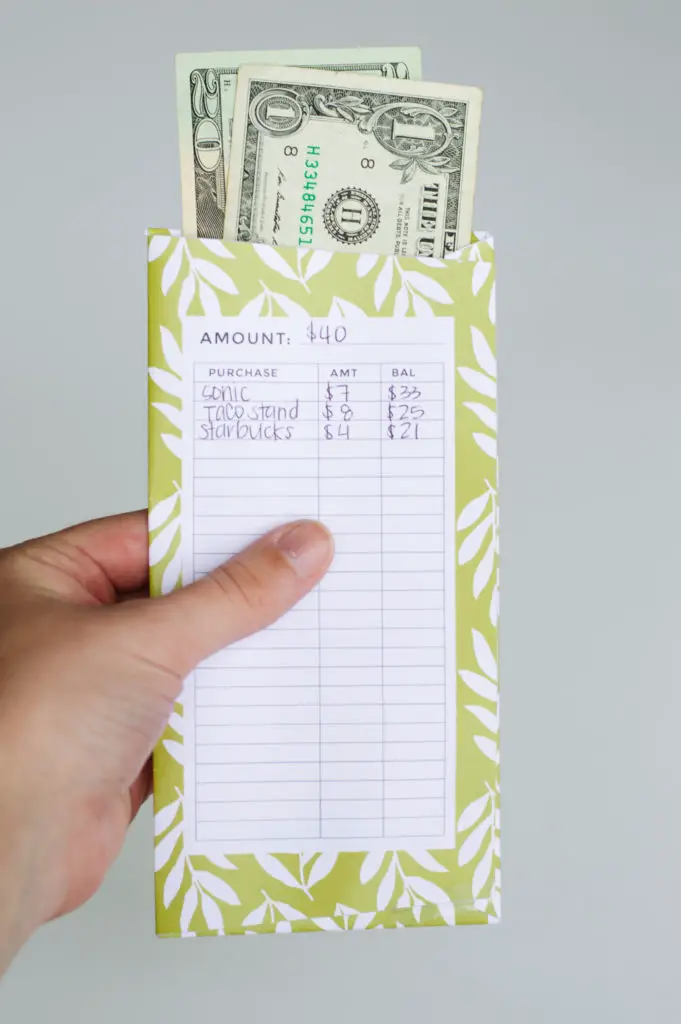

Do I need to track my purchases when I spend with cash?

This is optional! Some people like to track their cash right on the envelope as they spend, others like to be able to spend the cash without having to track every tiny transaction. I personally prefer not to track my cash spending, but I do track all my card purchase and bills.

Is it safe to carry lots of cash around all the time?

Only carry on your person the cash envelopes you will need when you go out. This helps avoid losing money or having money stolen. So for example, keep all your envelopes at home and grab your grocery envelope when you’re on your way to the store. Grab your beauty envelope when you’re on your way to get your eyebrows waxed. You do have to put a little pre-planning into your spending and outings with this method!

Can I borrow cash from another envelope when I run out of cash in one?

You can, but I don’t recommend it. This method requires you to practice discipline. Budget accurately and then stick to the plan you made. If you get into the habit of borrowing from other envelopes, you’ll end up spending money you need later on. Make borrowing from other envelopes rare.

Are there any questions about the cash envelope method that I didn’t answer? Let me know!

Did you enjoy this post? Pin this to Pinterest for later!