I'm Merilee & This is My Husband, Derek!

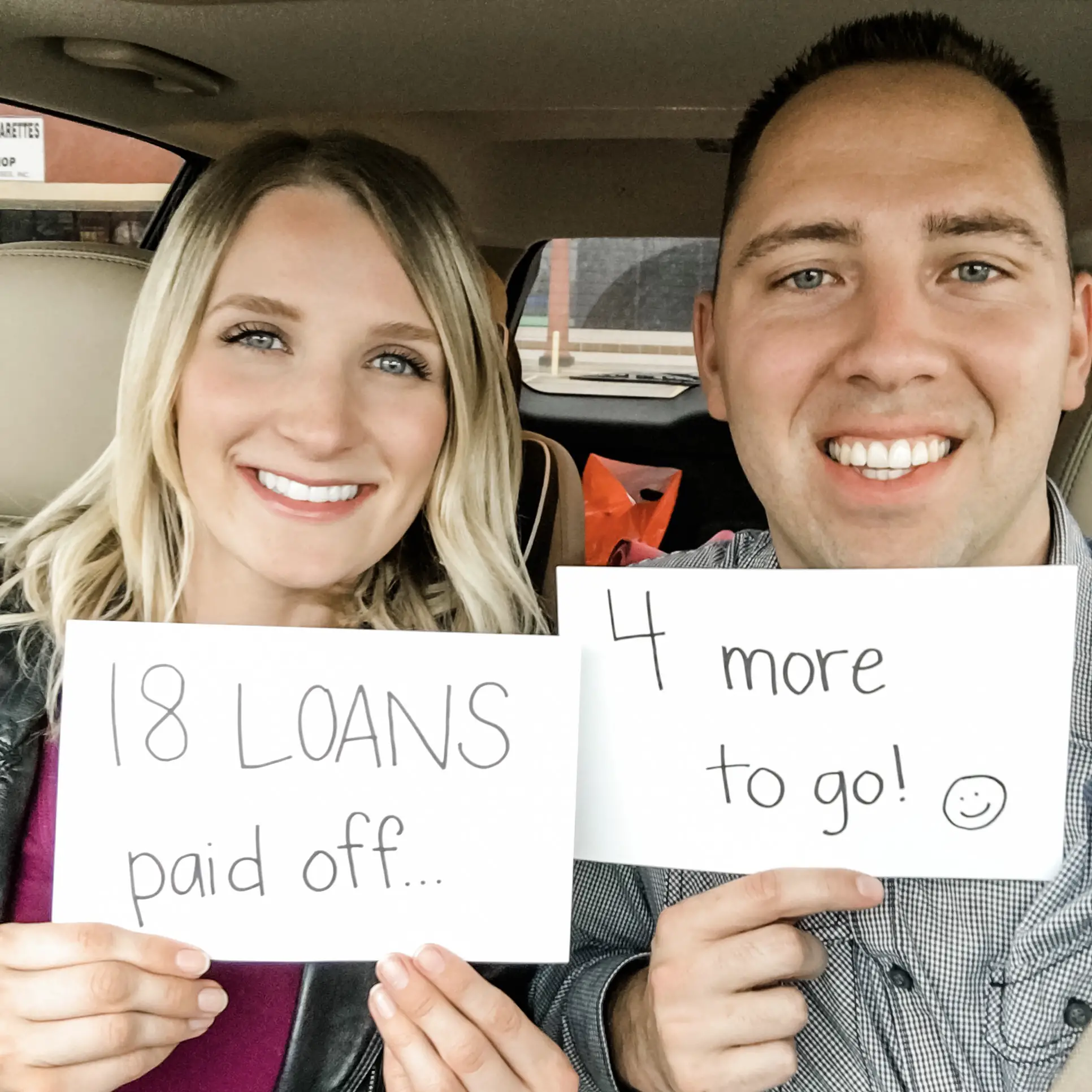

We paid off $71,000 of consumer and student loan debt in 2 ½ years using the tools and resources we now share.

We wanted to share our success with other families like us, so we created Easy Budget. Want to get to know us a bit better? Read more about our journey and how we can help you below!

We transformed our finances in just 3 years!

In 2016 we were recent college grads living paycheck-to-paycheck on one income.

We had two children to support and even though we felt like we were making a decent income, the money was always flying out the window.

We were getting nowhere! We thought we would have all this extra money, but we were always broke. I knew we were doing something wrong.

I spent the next several months researching budgeting and debt payoff, and in January 2017 we began our financial transformation.

I started by adding up all our debt. We had $71,000 of student loan, car, and credit card debt. I had no idea!

Our $1300/month minimum payments were robbing us of our hard-earned dollars.

We immediately got on a real budget, made a plan to pay off our debt, and starting working at it with laser focus.

In August 2019, we became debt free!

Read my article How We Paid Off $71k of Debt in Less Than 3 Years on a Single Income for more details.

We are now financially confident and literate, still living on a budget, saving like crazy, fully self-employed and working toward our dreams of early retirement. The peace, gratitude, and confidence we feel with our finances is everything we hoped it would be.

And now, I’ve made it my mission to reach as many other families as I can so they can experience this peace, gratitude, and confidence too. I’m talking about YOU! You can do it too.

Let me show you how to get started!

The 2 Financial Tools You Need:

Step 1: BUDGET EVERY DOLLAR YOU EARN

A solid budget is the secret sauce to financial success. A budget is simply planning how you’ll spend the money you earn, and following that plan. ALL of my success can be attributed to finally figuring out how to properly budget! And now, I’ll show you how to turbo-charge your own success with this budgeting method too!

- Written explanation of how to budget by paycheck using a zero-based budget

- Recommended resources

- FREE Digital Budgeting Spreadsheet Download

- Guided Video Tutorial

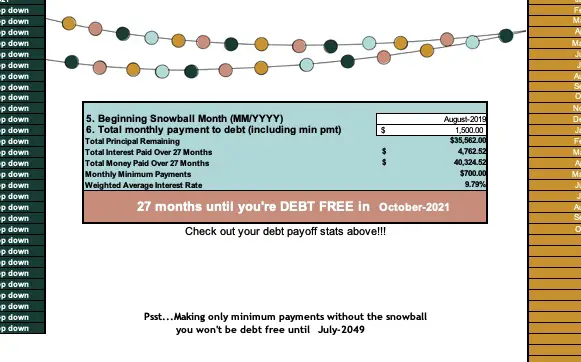

Step 2: CALCULATE YOUR DEBT-FREE DATE

Your credit card and loan payments are holding you back. You can’t make progress on your financial journey until you add up all your debt and make a plan to pay it off! This tool will help you calculate how soon you can be debt free so you can get to work with confidence that you will finish! We created this tool to help you and your partner see the power of an aggressive debt pay-down plan!